We help with year end accounts

In the UK, year-end accounts are a vital aspect of financial management for businesses. In the UK, year-end accounts are a vital aspect of financial management for businesses. Every business needs to prepare a set of accounts for HMRC and/or Companies House. Preparation of end of year accounts is a time consuming and daunting task. Many businesses struggle to get their accounts to Companies House and HMRC in time for the deadline and risk incurring penalties.

Make sure you’re not one of those companies. dns accountants can take the strain and make sure you meet the deadline and your year end accounts accurately reflect the business. But we also go a step further, we’ll pinpoint where improvements and savings for the future growth of your business can be made.

BOOK A CALL BACK REQUEST A FREE CONSULTATION CALL US

Built by accountants just for you

There are huge benefits to getting your year end accounts completed by dns,

here’s just a few of them…

Free Business Software!

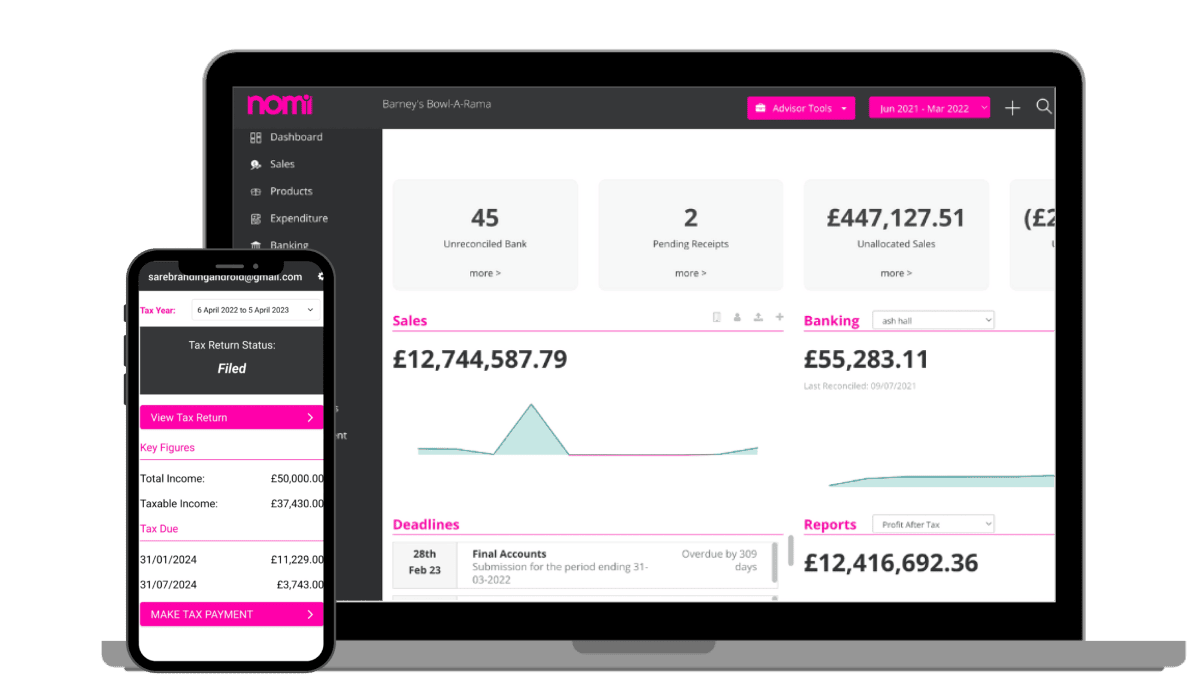

Say Goodbye to Bookkeeping Hassles: Nomi offers

accounting Free Receipt Processing and big savings!

Built in payment

solutions.

Hasslefree Bookkeeping

Snap pictures of

receipts using the

mobile app

Connect your bank

for easy reconciliation

Track your debtors

and creditors

Free Receipt Processing

Accounting anywear

Our leading year end accounts service gives you problem-free accounts preparation, filing and review service. Our services will suit all types of businesses and include:

- Abbreviated accounts

- Partnership accounts

- Sole Trader accounts

- Rental accounts

- Dormant accounts

- Corporation tax returns

Accounting anywear

Our leading year end accounts service gives you problem-free accounts preparation, filing and review service. Our services will suit all types of businesses and include:

- Abbreviated accounts

- Partnership accounts

- Sole Trader accounts

- Rental accounts

- Dormant accounts

- Corporation tax returns

Accounting anywear

Our leading year end accounts service gives you problem-free accounts preparation, filing and review service. Our services will suit all types of businesses and include:

- Abbreviated accounts

- Partnership accounts

- Sole Trader accounts

- Rental accounts

- Dormant accounts

- Corporation tax returns

Accounting anywear

Our leading year end accounts service gives you problem-free accounts preparation, filing and review service. Our services will suit all types of businesses and include:

- Abbreviated accounts

- Partnership accounts

- Sole Trader accounts

- Rental accounts

- Dormant accounts

- Corporation tax returns

See how dns can helpyou today.

Do you need a year end accounts service from an expert, friendly, no-nonsense team?

Give us a call today on 03300 886 686 to speak to our advisors, we'll

find the right solution to all accounts needs.

Trusted reviews

Read what our clients think about us

I am writing this email as a token of appreciation for Manish Garg, who is our lead accountant for the past...

Read moreWe work with DNS Associates for 4 years now and we always had a feeling that our problems and questions are top...

Read moreDNS Associates provides cost effective and very professional services. My accountant Sneha Gurudutta has been...

Read moreVery professional and efficient team. I will highly recommended to all small or big business owners...

Read moreI’m a new client and Debangshu Sarkar has been reliable, timely and informative to date. Very impressed...

Read moreExcellent services, my account manager Amit Gupta always there for me, excellent work on time and take...

Read moreI recently starteed my own company and in need of a good accountant. With my friends reference, I started...

Read moreI have been using DNS Services over a year from setting up my company till date. They are extremely professional...

Read moreAmbarish V

I am writing this email as a token of appreciation for Manish Garg, who is our lead accountant for the past couple of years. Manish is a very helpful person who often goes above and beyond to ensure that clients are fully satisfied and happy with the service provided by DNS. He also has a friendly attitude coupled with excellent subject knowledge and attention to detail, and is certainly a great asset for the company. Owing to such a fantastic service provided by Manish, I will always recommend DNS associates to all my contractor friends and colleagues.

Max Floor UK

We work with DNS Associates for 4 years now and we always had a feeling that our problems and questions are top priorities for them, especially Elena Ursuta our account manager who always helped us out. Would recommend DNS.

Jivan Sharma

DNS Associates provides cost effective and very professional services. My accountant Sneha Gurudutta has been always very keen to assist with whatever queries I may have. They are punctual and provide excellent service throughout.

Jhon Gill

Very professional and efficient team. I will highly recommended to all small or big business owners. Amit Gupta is our account manager and he is handling our two companies accounts. he is very helpful and he always notify us time to time . Thank you Amit Gupta and all DNS accountants team.

Freddie Sam Webber

I’m a new client and Debangshu Sarkar has been reliable, timely and informative to date. Very impressed with the service.

Ghofran Abdelrehem

Excellent services, my account manager Amit Gupta always there for me, excellent work on time and take every extra mile for my business, always gives the time to explain. Really can’t complain.

Sateesh B

I recently starteed my own company and in need of a good accountant. With my friends reference, I started DNS accountancy services and I am a quite satisfied with their service. My account manager Sneha Gurudutta was always responsive and guided me a lot especially during my company early days. Keep u the good work.

Satya Suresh

I have been using DNS Services over a year from setting up my company till date. They are extremely professional and flexible.We get support on weekends too which is a handy. Above all Sneha Gurudatta is always helpful and very quick in getting up the things done.Thanks a lot for the good job Sneha. I already recommended few people and will continue the same in future .Thank you.

What are Year-End Accounts: Frequently Asked Questions

Annual accounts and tax returns for private limited companies are a summary of financial statements or records of a set of periods like the annual year that includes required information regarding financial transactions, income and expenses, performance and financial status.

To prepare annual accounts for a private limited company, you must keep handy these information:

- a balance sheet

- a profit and loss account

- notes about the accounts that include any financial statement

- a director’s report

- an auditor’s report (unless the company is exempt from audit)

An accounting year is an accounting period of a company's yearly financial reporting period. A company needs to prepare several reports related to tax and income or expenses based on their accounting year.

A "fiscal year-end" means the completion of any one-year or 12-month accounting period which is not a typical calendar year (1st Jan to 31st Dec). Companies use this fiscal year-end for annual financial statement calculations and fix their fiscal year-end initially when forming a new company.

The Companies House decides the year-end for a limited company at the time of company formation. The year-end date will fall on the day before that date (in which the company was formed) in the following calendar year. The limited company end of year accounts will work according to the start date.

Yes, you can do your end-of-year accounts whether you are working as a director of a limited company or self-employed. However, you must have strong knowledge of accounts or bookkeeping otherwise it can be difficult, and mistakes can happen that can cost you heavily. Hiring an expert to file end-of-year accounts can save you from tax penalties. The year-end accounts cost will not go beyond paying these penalties.

The year-end accountants will work on your year-end closing. A year-end accounting checklist that a year-end accountant needs to prepare is:

- Prepare a closing schedule

- Gather outstanding invoices & receipts

- Review asset accounts

- Reconcile all transactions

- Close out accounts receivable and payable

- Accrue accounts receivable

- Accrue accounts payable

- Adjust grants and entitlements

An accountant will also help you to complete all the related tasks of year-end closing before the year-end accounts deadline.

Still have questions?

Free Business Software!

Limited time only!

Free Business Software

Say Goodbye to Bookkeeping Hassles: Nomi offers Free Receipt Processing and big savings!

- Built in payment solutions.

- Track profitability, debtors and creditors

- Snap pics of receipts with the mobile app

- Free Receipt Processing

- Hasslefree Bookkeeping

- Cost Reduction

Close

We are using cookies to give you the best experience on our website. By accepting to use our website, you agree to our cookies policy

X