We help with for VAT returns

To lots of people VAT appears to be a complex tax with lots of administration. Deciding whether to register for VAT is key, particularly for business start-ups. You can register voluntarily, or if your turnover is over £90,000 you must register.

The dns VAT return service is cost effective VAT registration and VAT returns service that helps you to register for VAT and file accurate VAT returns for you on time, every time.

BOOK A CALL BACK REQUEST A FREE CONSULTATION CALL US

Built by accountants just for you

There are huge benefits to getting your VAT returns completed by dns,

here’s just a few of them…

Free Business Software!

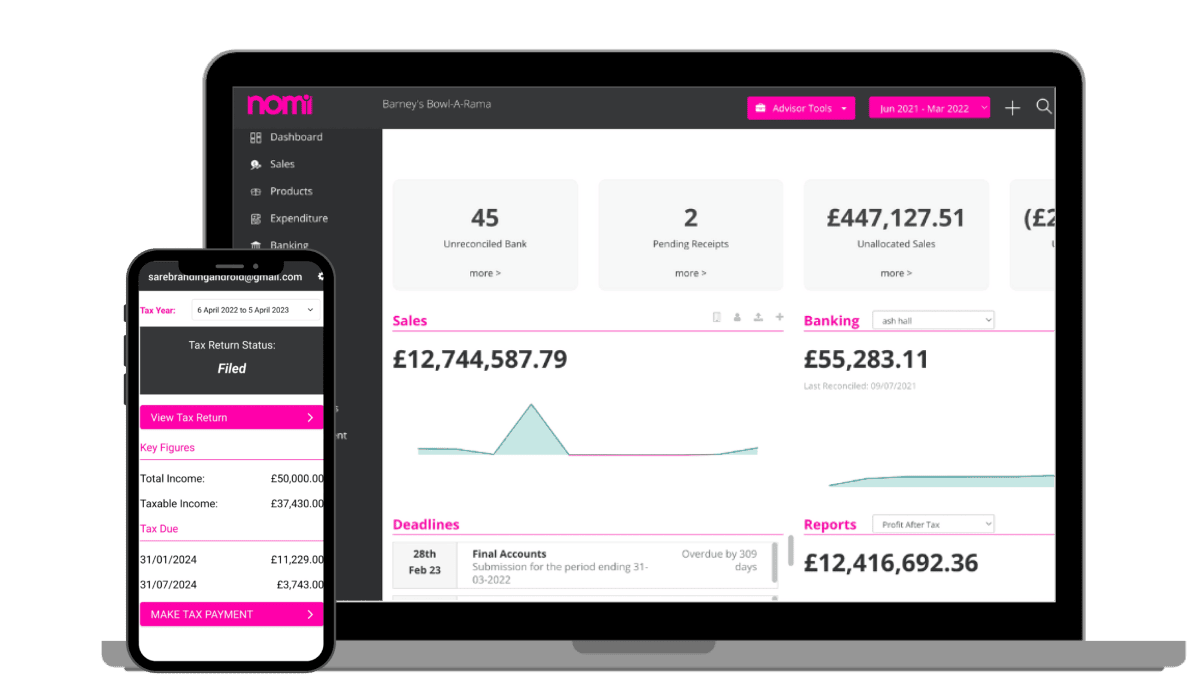

Say Goodbye to Bookkeeping Hassles: Nomi offers

accounting Free Receipt Processing and big savings!

Built in payment

solutions.

Hasslefree Bookkeeping

Snap pictures of

receipts using the

mobile app

Connect your bank

for easy reconciliation

Track your debtors

and creditors

Free Receipt Processing

VAT return services

Our leading VAT returns service gives you problem-free VAT registration and filing. We promise you:

- No penalty guarantee

- Fixed fee, no surprises

- Simple, painless process

- All statutory requirements met

Accounting anywear

Our leading VAT returns service gives you problem-free VAT registration and filing. We promise you:

- No penalty guarantee

- Fixed fee, no surprises

- Simple, painless process

- All statutory requirements met

Accounting anywear

Our leading VAT returns service gives you problem-free VAT registration and filing. We promise you:

- No penalty guarantee

- Fixed fee, no surprises

- Simple, painless process

- All statutory requirements met

Accounting anywear

Our leading VAT returns service gives you problem-free VAT registration and filing. We promise you:

- No penalty guarantee

- Fixed fee, no surprises

- Simple, painless process

- All statutory requirements met

See how dns can help you today.

Do you need VAT registration or help with your VAT returns from a friendly, no-nonsense team? Give us a call today on 03300 886 686 to speak to our advisors, we'll find the right solution to all your VAT needs.

Trusted reviews

Read what our clients think about us

I am writing this email as a token of appreciation for Manish Garg, who is our lead accountant for the past...

Read moreWe work with DNS Associates for 4 years now and we always had a feeling that our problems and questions are top...

Read moreDNS Associates provides cost effective and very professional services. My accountant Sneha Gurudutta has been...

Read moreVery professional and efficient team. I will highly recommended to all small or big business owners...

Read moreI’m a new client and Debangshu Sarkar has been reliable, timely and informative to date. Very impressed...

Read moreExcellent services, my account manager Amit Gupta always there for me, excellent work on time and take...

Read moreI recently starteed my own company and in need of a good accountant. With my friends reference, I started...

Read moreI have been using DNS Services over a year from setting up my company till date. They are extremely professional...

Read moreAmbarish V

I am writing this email as a token of appreciation for Manish Garg, who is our lead accountant for the past couple of years. Manish is a very helpful person who often goes above and beyond to ensure that clients are fully satisfied and happy with the service provided by DNS. He also has a friendly attitude coupled with excellent subject knowledge and attention to detail, and is certainly a great asset for the company. Owing to such a fantastic service provided by Manish, I will always recommend DNS associates to all my contractor friends and colleagues.

Max Floor UK

We work with DNS Associates for 4 years now and we always had a feeling that our problems and questions are top priorities for them, especially Elena Ursuta our account manager who always helped us out. Would recommend DNS.

Jivan Sharma

DNS Associates provides cost effective and very professional services. My accountant Sneha Gurudutta has been always very keen to assist with whatever queries I may have. They are punctual and provide excellent service throughout.

Jhon Gill

Very professional and efficient team. I will highly recommended to all small or big business owners. Amit Gupta is our account manager and he is handling our two companies accounts. he is very helpful and he always notify us time to time . Thank you Amit Gupta and all DNS accountants team.

Freddie Sam Webber

I’m a new client and Debangshu Sarkar has been reliable, timely and informative to date. Very impressed with the service.

Ghofran Abdelrehem

Excellent services, my account manager Amit Gupta always there for me, excellent work on time and take every extra mile for my business, always gives the time to explain. Really can’t complain.

Sateesh B

I recently starteed my own company and in need of a good accountant. With my friends reference, I started DNS accountancy services and I am a quite satisfied with their service. My account manager Sneha Gurudutta was always responsive and guided me a lot especially during my company early days. Keep u the good work.

Satya Suresh

I have been using DNS Services over a year from setting up my company till date. They are extremely professional and flexible.We get support on weekends too which is a handy. Above all Sneha Gurudatta is always helpful and very quick in getting up the things done.Thanks a lot for the good job Sneha. I already recommended few people and will continue the same in future .Thank you.

Frequently asked questions for VAT return services

Got questions?

To the uninitiated VAT may appear a complex tax system that involves a lot of administration. dns accountants offer this cost effective VAT registration and returns service to assist businesses with making the right decision as to whether to register at all; registering them, and then filing accurate VAT returns on time. It’s best to talk to a dns accountants tax advisor about the advantages and disadvantages of becoming VAT registered before you do anything

Deciding whether to register for VAT or not is a key decision particularly for business start-ups. Businesses can register voluntarily, and whether or not it is advantageous is a crucial management decision. Businesses must register within 30 days if turnover exceeds £90,000 in the previous 12 months, similarly if turnover is expected to exceed £90,000 in the following 30 days, the business must notify HMRC within 30 days of the date the threshold is expected to be exceeded.

It may be advantageous to register for VAT voluntarily to take advantage of things such as repayments of VAT because when you’re registered you can charge VAT on business taxable supplies and goods (output tax) and you can reclaim the VAT on your business purchases (input tax). If more input tax has been paid than output tax, HMRC will refund the difference. This can be useful at the start of a business when most business purchases are made. Being VAT registered may also offer your business more credibility, and if your supplies are zero rated, you can still reclaim VAT on the business purchases, resulting in a refund from HMRC.

But this must be weighed against the increased workload because once VAT-registered, your business must account for output tax on all taxable supplies, keep proper VAT records and accounts, and send in VAT returns when requested to do so by HMRC.

dns accountants will help your business come to a decision about whether to register. Then dns accountants will manage the registration for you. After registration, dns will then take on the increased administration for you and keep ahead of changing VAT regulations, calculate your VAT liability, and complete your VAT return. dns accountants will ensure you never face a penalty for late submission, inaccuracy, or late payment.It's simple contact us today to sign up for the service.

dns accountants have a team of Tax and VAT specialists that will advise you from start to finish and deal with HMRC for you at every step of the process: registration, correspondence from HMRC, filing VAT returns, dealing with queries, and keeping up with the complexities of VAT regulation.

dns accountants collect information on the relevant factors of your business and then advise you as to whether your business should register for VAT. If your business is required to register for VAT then dns will apply for VAT registration on your behalf, HMRC respond with registration, and then continue to work with you on your VAT returns.

dns offer this service at a very reasonable price, and new businesses may take advantage of our company formation package that includes VAT registration. For full details on prices please check our Pricing section.

- Award Winning Accountancy Firm

- No Penalty Guarantee

- Efficient filing of your Self -Assessment Tax Return

- Competitive Prices and Fixed Monthly Fees.

- A dns tax specialist to deal with the Inland revenue on your behalf

- Business Start Up Service: Helping/ Hand Holding Start Up Businesses.

- Tax planning advice and implementation

- Friendly team and a DEDICATED ACCOUNT MANAGER (ONE POINT OF CONTACT) to help you build your business.

- Guarantee SAVINGS of up to THOUSANDS OF POUNDS of Taxes and Guidance on Benefits, Expenses and Pensions

- Business Growth System

- Unlimited Ongoing Support and Advise

- Tax Investigation Cover

Still have questions?

Free Business Software!

Limited time only!

Free Business Software

Say Goodbye to Bookkeeping Hassles: Nomi offers Free Receipt Processing and big savings!

- Built in payment solutions.

- Track profitability, debtors and creditors

- Snap pics of receipts with the mobile app

- Free Receipt Processing

- Hasslefree Bookkeeping

- Cost Reduction

Close

We are using cookies to give you the best experience on our website. By accepting to use our website, you agree to our cookies policy

X