SDLT Stamp Duty Land Tax Advice

Stamp duty land tax (SDLT) is a tax imposed on property purchases in the UK, and navigating its complexities can be challenging. As leading SDLT advisors, dns accountants offer expert guidance tailored to individuals, landlords, companies, solicitors, and non-residents. Our team specialises in providing comprehensive SDLT advice, including assistance with Multiple Dwellings Relief (MDR) and reclaiming HMRC stamp duty refunds.

If you need assistance with SDLT refunds, our experienced stamp duty land tax advisors ensure a smooth process to secure your rightful refund. We understand the intricacies of SDLT and are committed to helping you minimise your tax liabilities effectively. Contact us today for reliable SDLT advice and support in managing your stamp duty land tax obligations.

BOOK A CALL BACK CALL USMultiple Dwellings Relief for SDLT

SDLT Anti Avoidance Rule

Stamp Duty Appeals

Stamp Duty on Commercial Properties Explained

What is stamp duty land tax?

Stamp duty land tax (SDLT) is a tax paid on property purchases in the UK. Understanding SDLT is crucial for homebuyers, as it can significantly impact your budget. Accountants can provide expert SDLT advice, helping you navigate the complexities of the tax. Whether you're a first-time buyer or an investor, professional guidance ensures you make informed decisions and potentially save money on your tax obligations.

How much is stamp duty?

Stamp duty land tax (SDLT) is a tax on property purchases in the UK. The amount you pay depends on the property's price and its location. Here’s a simple breakdown:

- Main property purchase: SDLT applies if the cost exceeds £250,000.

- First-time buyers: May be exempt from SDLT on properties under certain thresholds.

- Rate bands:Different rates apply based on the purchase price.

For tailored advice, consider our SDLT Advice to navigate these complexities effectively. Understanding the rates can save you money when buying your new home.

Built by accountants just for you

We’ve got a huge amount of SDLT tax-saving strategies to help you. There are huge benefits to SDLT tax planning and using the dns team advice for SDLT on the purchase of land or property. Here’s just a few of them…

tax bill

reliefs

plans

mind

Free Business Software!

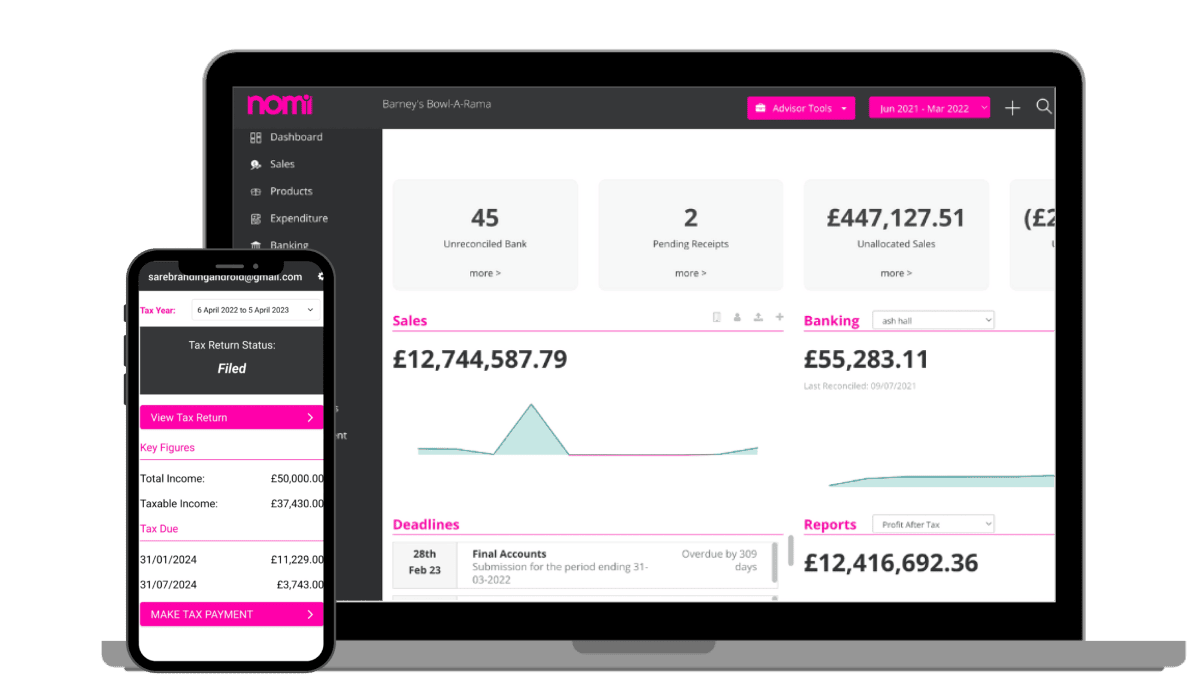

Say Goodbye to Bookkeeping Hassles: Nomi offers

accounting Free Receipt Processing and big savings!

Built in payment

solutions.

Hasslefree Bookkeeping

Snap pictures of

receipts using the

mobile app

Connect your bank

for easy reconciliation

Track your debtors

and creditors

Free Receipt Processing

SDLT services by dns accountants

Our highly experienced SDLT tax advisors and tax team provide comprehensive assistance for all your tax planning requirements, personal, corporate, and inheritance tax including SDLT advisory service, Stamp Duty Land Tax (SDLT) experts. Here are some key areas where we can help:

- Minimizing SDLT for property developers and builders.

- SDLT for 'mixed use' properties.

- Multiple Dwellings Relief (MDR).

- Claim back additional 3% SDLT surcharge paid to HMRC

- Consultation services for HMRC enquiries related to SDLT.

- SDLT services for staircase arrangements and transfers of properties to group companies, such as Group Relief Claim.

- SDLT on First time home buyers relief.

- SDLT advice for non-residents and companies.

- Property transfer on liquidation of companies.

- Transfers Involving the dissolution of a civil partnership SDLT on leases

- Navigate transfers involving the dissolution of a civil partnership as SDLT on 'mixed-use' properties and SDLT on leases effortlessly.

- Claim derelict property

- Transfer of equity

- Advising non-resident individuals and companies

Stamp duty land tax rates

Rates for stamp duty land tax (SDLT) vary based on property value and buyer circumstances. Understanding these rates is crucial for anyone involved in property transactions. Below is a explanation the current SDLT rates for residential properties:

| Property Value | SDLT Rate |

|---|---|

| Up to £125,000 | 0% |

| £125,001 - £250,000 | 2% |

| £250,001 - £925,000 | 5% |

| £925,001 - £1.5 million | 10% |

| Over £1.5 million | 12% |

For those looking expert guidance, our SDLT advice can help navigate these rates effectively. Whether you're a first-time buyer or an experienced investor, understanding stamp duty land tax is essential to making informed decisions in your property transactions. Contact us for tailored SDLT advice to ensure compliance and optimise your tax situation.

See how dns can help you today.

Looking to manage your stamp duty land tax (SDLT) or need expert advice? Our team of knowledgeable SDLT experts can assist you with comprehensive tax planning, including Multiple Dwellings Relief (MDR), SDLT refund & reclaim, SDLT MDR(Multiple Dwelling Relief), and stamp duty refund applications. We help you for stamp duty land tax return on an additional 3% SDLT surcharge paid to HMRC and manage SDLT on 'mixed-use' properties and leases.

Book a call today to speak with our specialist property accountants. We'll ensure that we find the perfect solution for all your SDLT requirements

Trusted reviews

Read what our clients think about us

I am writing this email as a token of appreciation for Manish Garg, who is our lead accountant for the past...

Read moreWe work with DNS Associates for 4 years now and we always had a feeling that our problems and questions are top...

Read moreDNS Associates provides cost effective and very professional services. My accountant Sneha Gurudutta has been...

Read moreVery professional and efficient team. I will highly recommended to all small or big business owners...

Read moreI’m a new client and Debangshu Sarkar has been reliable, timely and informative to date. Very impressed...

Read moreExcellent services, my account manager Amit Gupta always there for me, excellent work on time and take...

Read moreI recently starteed my own company and in need of a good accountant. With my friends reference, I started...

Read moreI have been using DNS Services over a year from setting up my company till date. They are extremely professional...

Read moreAmbarish V

I am writing this email as a token of appreciation for Manish Garg, who is our lead accountant for the past couple of years. Manish is a very helpful person who often goes above and beyond to ensure that clients are fully satisfied and happy with the service provided by DNS. He also has a friendly attitude coupled with excellent subject knowledge and attention to detail, and is certainly a great asset for the company. Owing to such a fantastic service provided by Manish, I will always recommend DNS associates to all my contractor friends and colleagues.

Max Floor UK

We work with DNS Associates for 4 years now and we always had a feeling that our problems and questions are top priorities for them, especially Elena Ursuta our account manager who always helped us out. Would recommend DNS.

Jivan Sharma

DNS Associates provides cost effective and very professional services. My accountant Sneha Gurudutta has been always very keen to assist with whatever queries I may have. They are punctual and provide excellent service throughout.

Jhon Gill

Very professional and efficient team. I will highly recommended to all small or big business owners. Amit Gupta is our account manager and he is handling our two companies accounts. he is very helpful and he always notify us time to time . Thank you Amit Gupta and all DNS accountants team.

Freddie Sam Webber

I’m a new client and Debangshu Sarkar has been reliable, timely and informative to date. Very impressed with the service.

Ghofran Abdelrehem

Excellent services, my account manager Amit Gupta always there for me, excellent work on time and take every extra mile for my business, always gives the time to explain. Really can’t complain.

Sateesh B

I recently starteed my own company and in need of a good accountant. With my friends reference, I started DNS accountancy services and I am a quite satisfied with their service. My account manager Sneha Gurudutta was always responsive and guided me a lot especially during my company early days. Keep u the good work.

Satya Suresh

I have been using DNS Services over a year from setting up my company till date. They are extremely professional and flexible.We get support on weekends too which is a handy. Above all Sneha Gurudatta is always helpful and very quick in getting up the things done.Thanks a lot for the good job Sneha. I already recommended few people and will continue the same in future .Thank you.

Got questions?

The property buyer always needs to pay the stamp duty land tax, not the seller. To deal with the stamp duty tax advice, you can hire SDLT experts at dns accountants and can get stress-free tax planning.

In some cases, a stamp duty refund can be claimed, like in your second home surcharge.If you sell your first property within three years of purchasing another one, your second property will become your primary residence, and you will be able to claim stamp duty refund on that. Claiming the refund requires you to complete an online HMRC form on the Gov.UK website.

After completing the HMRC online form, the claim can be processed within 15 days by HMRC. You can connect with dns accountants to get SDLT refunds with an easy process.

Yes, if you buy a second home, you need to pay stamp duty on the second home which is subject to a 3% surcharge on the standard SDLT rates. You can find some exemptions in it, and it would be better to get SDLT tax advice from experts.

SDLT is payable within 14 days when you purchase a property. If you submit it after 14 days or longer, you may end up paying penalties and interest, which HMRC will charge. A solicitor will submit the stamp duty on behalf of their client.

The non-residential and residential properties buyer of England and Northern Ireland pays Stamp Duty. In the case of non-UK residents, an additional SDLT rate of 2% will be charged by HMRC if you buy a property in England or Northern Ireland. HMRC stamp duty calculator can be used for easy calculation of your SDLT.

Yes, the stamp duty must pay for both non-residential and residential properties, and the mixed-use property is also one on which stamp duty is payable. The SDLT rates are lower on mixed-use and commercial properties than on residential ones.

There are a few situations where you can get stamp duty land tax relief.

First-time buyer's relief - if you are a first-time individual buyer and your property is residential with less than a certain price, you can quickly get a first-time buyer's relief. There are other reliefs, like purchases by a charity of land and property for charitable purposes, purchases of multiple dwellings, and right-to-buy purchases.

dns accountants can help you to identify the situation where you can get relief on SDLT. Our SDLT accountants will guide you properly for maximum tax relief.

We cater stamp duty land tax (SDLT) services to the given type of sectors:

- The first and second home buyers

- Commercial, derelict and probate properties

- Shared ownership

- Property developers

- The employers who are buying property and crown employees

- Property which is bought from limited companies

- Investors

- Group relief

- Freeport tax sites

- Charities

Connect with us to hire our property accountant services.

There are few circumstances or reliefs where people can examine that they have overpaid Stamp Duty Land Tax. These are the SDLT reliefs:

- granny annexe,

- property with land attached,

- property that includes commercial activity,

- income from the land like rents, certain wayleaves, licence fees etc.

- Any interest over the land.

An SDLT expert can guide you well in claiming it back.

These are the scenarios where you will have to pay a 3% additional SDLT surcharge:

- 3% SDLT surcharge on additional properties for £40,000 or more, whether a holiday home, a buy-to-let etc.

- If you have any share in another property worth £40,000 or more.

- If you have shares in any property in the world and are buying your first home in the UK.

A refund claim can be made up to 12 months after the date you have filled the original SDLT return, i.e. 14 days after the completion of the original purchase.

These are the Stamp duty land tax (SDLT) rates for single residential properties

- Up to £250,000, there will be Zero

- From £250,001 to £925,000, there will be a 5%

- From £925,001 to £1.5 million, there will be a 10%

- Above £1.5 million, there will be a 12%

A 3% surcharge over this will be charged if you own another residential property. Yes, you can get an SDLT refund with some reliefs available

SDLT for residential properties applies to over £250,000.

- Up to £250,000, there will be zero

- From £250,001 to £925,000, there will be a 5%

- From £925,001 to £1.5 million, there will be a 10%

- Above £1.5 million, there will be a 12%

For stamp duty registration fee, visit this gov site: https://www.gov.uk/guidance/hm-land-registry-registration-services-fees

In this case, if you are a tenant of a commercial property. You need to calculate SDLT payable amount and pay it on time. There will be no responsibility of landlords for SDLT. To understand it clearly, hiring an SDLT specialist or accountant is recommended to check whether you are liable to pay tax.

Yes, the cost represented by Stamp Duty Land Tax can be treated as a capital expense for accounting purposes.

No, you can't pay stamp duty in instalments

Yes, In the case of multiple dwellings, you will not have to pay below a certain amount, but you will have to pay above a specific price. You can also check Multiple Dwelling Relief to avail other benefits.

There are no circumstances that allow you to add Stamp duty to your mortgage. But you can have some other options instead.

No, you don't need to pay stamp duty as a seller. Only buyers of the house or property need to pay.

Owning a rental property, will I have to pay the 3% SDLT surcharge if I buy my first home in the UK?

Technically yes, you will have to pay the 3% SDLT surcharge, but there can be some situations where you can get relief, and an expert can introduce you to the best possible solution.

There are a few circumstances where you overpaid Stamp Duty Land Tax, but later on, you can claim back.

Still have questions?

Free Business Software!

Limited time only!

Free Business Software

Say Goodbye to Bookkeeping Hassles: Nomi offers Free Receipt Processing and big savings!

- Built in payment solutions.

- Track profitability, debtors and creditors

- Snap pics of receipts with the mobile app

- Free Receipt Processing

- Hasslefree Bookkeeping

- Cost Reduction

Close

We are using cookies to give you the best experience on our website. By accepting to use our website, you agree to our cookies policy

X