Hassle free accounting

All your accounting needs in one place. Online accounting & bookkeeping software and in person with our friendly team.

- No penalty guarantee

- 4 hour response

- Dedicated account manager

- Free cloud software

Here at dns we support thousands of businesses and their owners across the UK in a huge range of sectors. Whether you’re a startup, small business or growing business, we offer all the support, advice, and services you need to make your business a success.

Our business packages include a range of services to suit your needs and budget. We’re award winning small business accountants that offer services online and in person. If you’ve currently got an accountant but want to switch to dns, we make the switching process easy.

BOOK A CALL BACK REQUEST A FREE CONSULTATION

Our specialist accountants for small business offer a full range of services for all your accountancy, tax and business support needs.

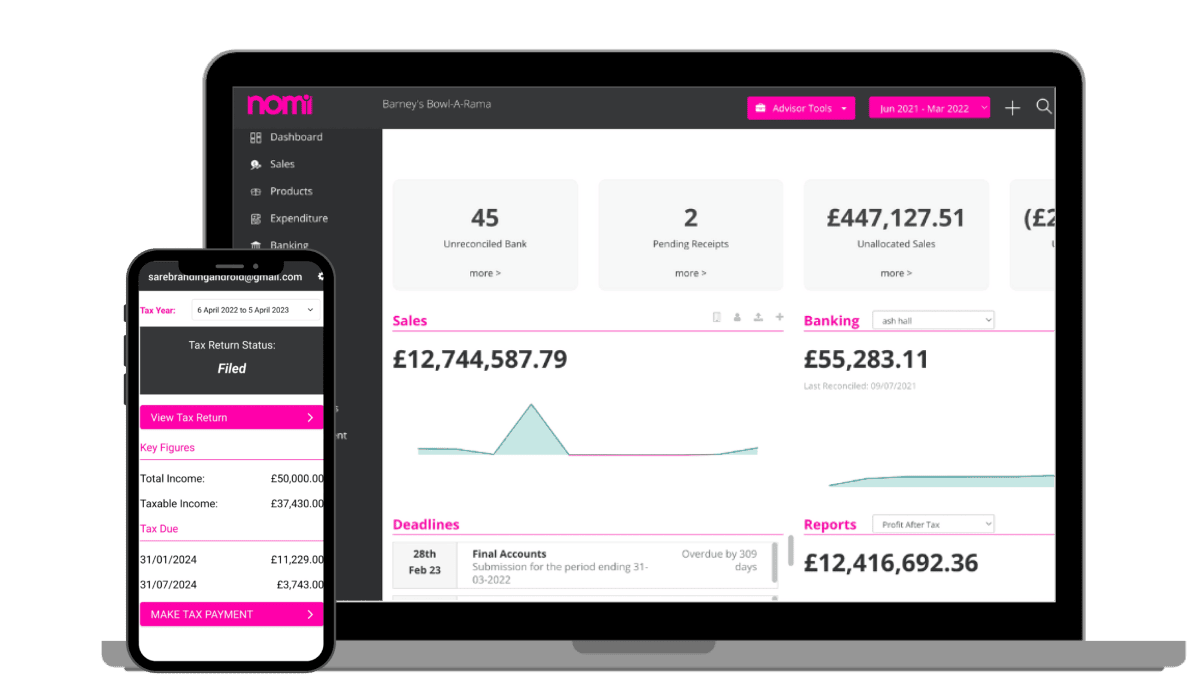

Say Goodbye to Bookkeeping Hassles: Nomi offers

accounting Free Receipt Processing and big savings!

Built in payment

solutions.

Hasslefree Bookkeeping

Snap pictures of

receipts using the

mobile app

Connect your bank

for easy reconciliation

Track your debtors

and creditors

Free Receipt Processing

We support and advise thousands of people just like you across the UK and abroad

with our amazing team of experts.

All your accounting needs in one place. Online accounting & bookkeeping software and in person with our friendly team.

Helping you navigate the complex rules around IR35

Our services give you complete control and support for all your contracting needs.

We've got a range of packages to suit all types

of people

dns accountants provides specialist accounting services for small businesses across a wide range of business sectors. Depending on your requirements we offer as many inputs as you need.

Rest assured that whichever package you choose, dns accountants guarantees you 100% satisfaction with whichever accountancy for small businesses service you take from us.

Choosing the right small business accountant is important as they act as a trusted partner who offers advice and guidance for your small business to grow. So it's important to choose the best accountant for your small business.

It's in your company’s best interests to have an experienced, capable person handling one of the most important areas of your business – your finances. The right person will save you time and money year after year.

dns accountants is a team of committed account managers who help small businesses achieve growth and keep on top of their finances. We provide ongoing advice and support to small business accountancy across a wide range of sectors in London and the surrounding areas.

As a specialist accounting practice, we are able to adapt to the needs of our clients and offer personalised service. Speak today with dedicated accountant to know more about completion of your accounts and tax returns.

When your small business starts growing, you will be required to have accounting services for financial reporting and accounts management. Apart from these, the other accounting services your business could require:

The P11D is a tax form that records employment benefits that the employees and directors of a company have received. This information enables HMRC to figure out if you're required to pay tax on these benefits.

You have to submit your year-end accounts to HMRC with your corporation tax return. These requirements have to be submitted online for your tax return – at the end of your company’s financial year. They are used as the basis of your tax calculations.

Our services include:

dns accountants specialise in providing advice on registering for VAT, VAT savings and avoiding potential risks, giving you complete peace of mind. We do more than just compliance and offer a specialist consultancy service.

Our VAT return services include:

Being a business owner means that you are responsible for informing HMRC of your annual income every year. While standard employees get their national insurance and tax calculated for them, self-employed workers must complete a self-assessment every tax year so that HMRC can be informed and collect this owed money.

dns accountants - UK's leading provider of tax investigation insurance services. We provide comprehensive coverage, with policies tailored to suit your needs.

Signing up or making the switch to dns accountants is simple. We make it

as quick and easy as possible.

Call us to chat through your requirements.

Schedule a meeting

online

Sign up and we’ll

do the rest

Managing your company's finances is a difficult process if you aren't familiar with recording transactions. dns accountants can help you by providing the financial expertise and guidance to run your business effectively.

Below are the reasons why should you choose dns accountants:

Hiring an accountant help closely with clients to maximise their profits and business growth, by offering the following benefits:

Our main aim at dns accountants is to provide a proactive service to our clients, whilst ensuring that they are making the most of any potential accountancy savings and tax relief. We take great pride in the work we carry out for our clients, as we always strive to build a strong relationship and provide the most pro-active service. Find out what our clients are saying about us here.

We offer a free consultation to any business or individual who feels that they may be missing out on potential savings, or paying too much for their accountancy, outsourcing or tax advisory services.

In order to manage your operations efficiently and to save on taxes, you as a small business owner can try and inculcate the following practices in your business operations to gain maximum tax benefit:

To ensure that you don’t end up overpaying on taxes, it is very important to know and understand the industry you are dealing with and in order to do so, you must improvise a well-thought method to have continuous engagement with your trade body or association. You must also try to attend all the events and programs organised by the association. The best way to keep you updated about all the recent happenings of your trade body is to subscribe to its newsletter. Allowances like uniform allowance and several other dispensations are approved by HMRC which you can use depending on the industry you are in. And last but not least, your trade body is on your side so you must make the most out of it to understand your industry better.

This is the second step after you have attained a thorough knowledge of your industry because if only you have understood your industry well enough, you can utilise the applicable allowances. The size, type and structure of your business will decide which parts of tax legislation you need to consider. A lot of small business owners are clueless about allowances like annual investment allowances, personal allowances, dividend allowances, marriage allowances etc. and thus miss out on taking their benefits.

A small business owner has a lot on his plate and thus he needs to be very prudent regarding his time allocation. Spending more than the required time on tasks such as bookkeeping and accounting will not only take the fair share of your productive time but also make you a jack of all trades and master of none, which for sure is not a desired characteristic for success. Your business will benefit from you if you are spending time working on it while hiring competent professionals for tasks such as bookkeeping and accounting. . Also, you must try not to get into the feeling of “ I know it all” because chances are high that in situations where you may think that you are saving money, you are actually losing out by not claiming allowances and deductions you are eligible and entitled to.

For most small business owners, dealing with VAT in the right manner has been a sore area for years because while the majority of them have no idea if they are paying the right amount or not, a lot of small business owners don’t even know if a scheme called as Flat Rate Scheme even exists on the planet earth, which could otherwise be an unexpected source of profit. As the name suggests, under the Flat Rate Scheme, you have to pay a single, flat rate of VAT on your annual turnover and HMRC has its own list of flat VAT rates for different industries. Thus, you can choose the flat rate as per your industry and pay accordingly. Also, where HMRC refrain from claiming any VAT on the purchases made, you can keep the difference between the VAT you charge to your customers, which is usually 20%. Thus, having a regular VAT health check could prove quite beneficial for your business.

HMRC has allowed generous tax savings for those who are self-employed and work from home and if you are a small business owner, you are self-employed in the eyes of HMRC, so you must be aware of tax-saving schemes. Being self-employed, you can claim either all or a certain percentage of the following expenses:

In order to avail tax benefits, you as a small business owner must ensure that you are paying your subscriptions with the HMRC and Companies House well within the deadline. Meeting all deadlines becomes a lot trickier when things are not going as smoothly as you would like them to be, but even then you have to make sure that you deal with the situation as soon as possible because doing so will give you and your advisor, if any, buffer time to liaise and reduce the penalties for late payment interest.

You have hired and paid your accountant to keep the company’s or business’s account in order but it doesn’t mean that your task is over. At the end of the day, it is your business so it is your duty to have a periodical meeting with your accountant to see if things are as they should be and address areas of concern, if any. Doing so will also keep your accountant under check and prevent him from going haywire and if you don’t talk to your accountant or if he is very busy giving you the time, change the accountant.

In order to save on tax, HMRC allows you to transfer some of your assets, savings and investments to your spouse or civil partner or to someone from your family who works in your business. However, you must be careful here so that you end up creating problems for those involved with regard to control or capital gains tax.

HMRC encourages everyone to save on their taxes by doing advanced planning and as a small business owner; you need to assess your profits in advance in order to claim any deductions well within time before it is too late to do so. For example, if you have calculated your profits, you can see if buying any qualifying plant or machinery or adding to pension contributions has any positive effect on reducing your taxable profits.

As a small business owner, you must have a well-planned exit strategy in place because having so will not only increase your chances of realising the best value from your business but will also allow you to have a tax-efficient exit and thus reduce the burden of income, capital and inheritance tax, if applicable.

The decision to change an accountant is a critical one and should be taken with utmost care. If you believe that you are not getting value for money from your accountant, it’s the right time to choose a new accountant. dns provides you with experienced, trusted and dedicated professional accountants who not only manage your accounts in compliance with tax legislation but also help you in finding tax-saving opportunities. Our accountants will cater to every need of yours and provide you with a cloud accounting solution. dns accountants help small businesses achieve the goals they desire.

At the meeting, discuss your requirements and any business issues or concerns you may have. Don’t hold back.

Once you have decided to switch, your new accountants need your permission in writing to obtain a copy of your accounting and tax records. This is done by signing a simple authorisation letter, which they should be able to provide. They will then do what is necessary to obtain your records.

Your new accountants will write to your current accountant notifying them of your intention to change. They will also provide you with a letter of engagement setting out your requirements and their duties as your new accountant. Make sure that all fees are clearly spelt out in your agreement, too, to protect you from unpleasant surprises.

For any questions, clarifications or further information don’t hesitate to get in touch. Contact us or schedule an appointment at your convenience.

The number of factors depends on the cost of an accountant for a small business. These factors include:

The cost of an accountant can be a fixed annual cost according to certain tasks like preparing and submitting your tax returns to HMRC. Usually, as a business owner how much should a small business pay for accounting services depends on the task requirement. You can also consult before hiring if “Is there a minimum contract period?”.

Limited time only!

Say Goodbye to Bookkeeping Hassles: Nomi offers Free Receipt Processing and big savings!

We are using cookies to give you the best experience on our website. By accepting to use our website, you agree to our cookies policy

X