All your accounting needs in one place. Online leading software and in person with our friendly team.

- No penalty guarantee

- 4 hour response

- Dedicated account manager

- Free cloud software

With changes happening for UK landlords and the buy-to-let market regularly, having property tax specialists that truly understand the property sector is crucial. There are many ways to minimise your tax bill and maximise the return on your property investment. This is where specialist property accountants and Tax advisors can assist you.

Whether you’re a buy-to-let landlord, individual landlord, corporate landlord, property dealer, estate management, non-resident investor, or a second property owner looking for a property accountant, we have packages and accounting services to suit your every landlord and property need. We provide expert advice from our buy-to-let accountant as part of our accounting services.

BOOK A CALL BACK REQUEST A FREE CONSULTATION

Confused about working out the landlord property tax and want help in calculating property tax to maximise return on your investment? dns accountants is UK’s leading property tax accountants providing property tax services to landlords and investment property holders. Not only an expert landlord accountant by your side, but we also assist clients in determining how to maximise their return on investment by availing all possible reliefs in light of recent tax changes.

With the pressure of increased taxation, having a buy-to-let accountant has big benefits. Due to the recent changes imposed by the chancellor, the buy-to-let market has become more challenging and stressful for landlords. Whether you are an experienced or a first-time buyer, it's crucial to understand how property taxes work to gain maximum return out of your investment. dns Accountants have qualified property tax accountants specialised in providing tax services to landlords and investment property holders. We work for a vast number of clients with property portfolios, including non-resident investors, residential and commercial property holders & developers, and corporate and individual investors. Our buy to let property accountants for landlords specialists follow a proactive approach to ensure you take advantage of the tax reliefs available and are one step ahead of constant tax changes.

Income from house property is considered as rental income of property according to the Income Tax Act. The property can be a building or the land adjoining it and is taxed under section 24 under the heading 'income from house property'.

Rent received from a commercial property, or a residential house is taxable under the same head.

The primary three taxes that apply to the UK landlord are - Stamp Duty Land Tax, Capital Gains Tax, and Income Tax. However, you do not pay them all at the same time. You pay stamp duty on the initial property purchase and capital gains tax on the sale of an investment property. Income tax is the only ongoing tax you will pay as a private landlord on owned buy-to-let property. If you purchase a buy-to-let property in the UK through a limited company, you will instead pay corporation tax on the rental income.

Keeping track of capital gains tax, stamp duty, corporation tax, expenses, and the huge number of other considerations that landlords face can be a challenge. Our property specialist accountant will tell you everything you need to know and do about the property taxes you'll pay as a landlord, including how to ensure you're paying your fair share. We'll define key terms and provide you with the most up-to-date information on all things related to property tax in 2023/24.

If you buy a property over a certain price in the UK, you are eligible to pay tax. For the exact tax, the person has to pay and the specific value of the property varies as it depends on your location and circumstances, hence it's better to seek advice from the landlord accountant as this can also help in considering the capital gain tax.

If you are earning money from letting a property then the person has to complete a self-assessment tax return, depending on your total income. The rate at which the income tax is calculated depends on the income you earn.

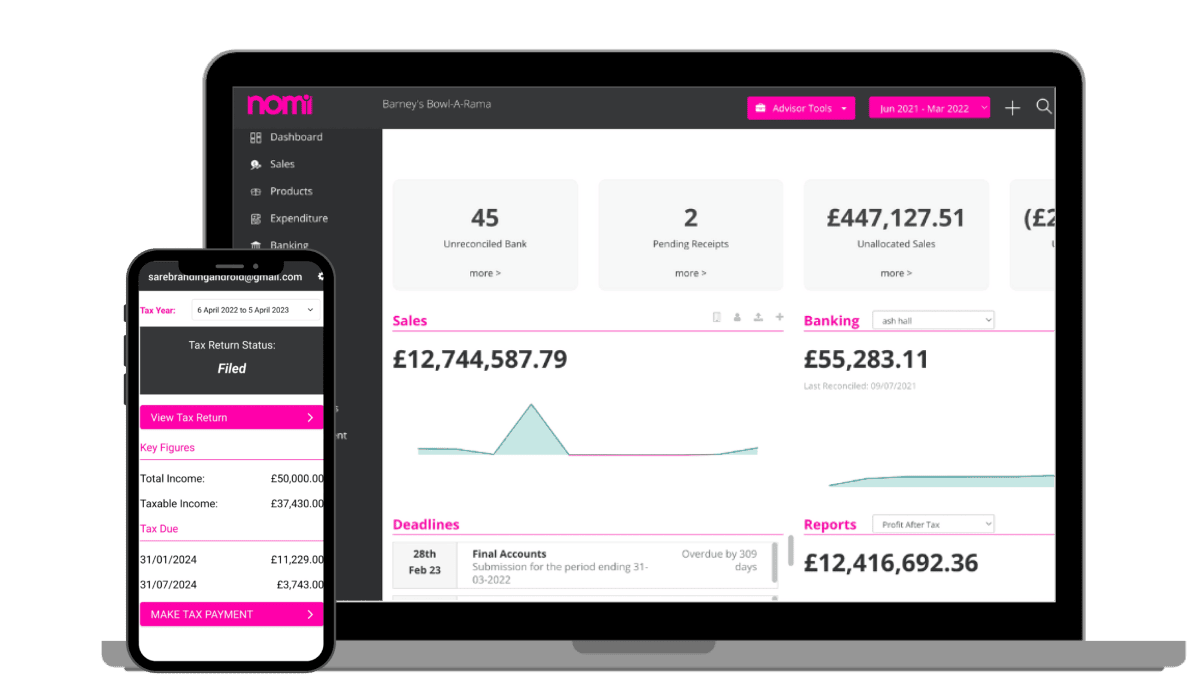

Say Goodbye to Bookkeeping Hassles: Nomi offers

accounting Free Receipt Processing and big savings!

Built in payment

solutions.

Hasslefree Bookkeeping

Snap pictures of

receipts using the

mobile app

Connect your bank

for easy reconciliation

Track your debtors

and creditors

Free Receipt Processing

Here at dns we support and advise thousands of landlords with all their accountancy,

tax and landlord needs through our expert property accountants.

Read our latest landlord property tax ebook download here

Our specialist property tax accountants offer a full range of services

for all your accountancy, tax, and landlord needs.

We support and advise thousands of people just like you across the UK and abroad

with our amazing team of experts.

All your accounting needs in one place. Online leading software and in person with our friendly team.

Helping you navigate the complex property tax rules

Our services give you complete control and support for all your landlord needs.

We've got a range of packages to suit all types

of people

Signing up or making the switch to dns accountants is simple. We make it

as quick and easy as possible.

Call us to chat through your requirements.

Schedule a meeting

online

Sign up and we’ll

do the rest

We're proud to be amongst the best accountants in the UK, demonstrated by the number of awards we've won over the years. We're also a top-100 accounting firm.

Got questions?

Ideally, it is the duty of the landlord to pay the property tax except nothing is mentioned explicitly in the contract between the landlord and the tenant. In certain circumstances, tenants can pay property tax and get the amount adjusted from the monthly rent. It is a matter of a rent agreement or lease deed, which is signed between the tenant and the landlord to determine who is responsible for paying the tax. If proper tax planning is not put in place, a large part of your rental income could be lost in paying taxes.

There are many financial and administrative responsibilities that you need to perform as a landlord. A landlord accountant helps guide how to register for self-assessment and complete annual tax returns for the rental income received by the landlord. Similarly, if a limited company owns the property, you must submit annual accounts and tax returns.

Along with the countless other responsibilities you have as a landlord, the financial landscape can be complex and onerous to navigate, even for the most experienced landlords. Property specialist accountants can help relieve the burden, allowing you to concentrate on the other aspects of being a successful landlord.

Not everyone is aware of the proper way to report rental income on their taxes. By obtaining the services of a landlord accountant, you eliminate the possibility of making a careless error. Finally, it's your accountant who will be able to tell you how rental income is taxed, what deductions you may claim, and which receipts you must keep in your records. Thus, we recommend you hire an accountant with expertise in property taxation. A property specialist accountant can also assist you if you are unsure whether to own property in your personal name or through a limited corporation.

There is a checklist which HMRC provides to know allowable income tax expenses for landlords. To know what you are allowed to claim depends on the kind of property (letting a residential property, a furnished holiday let or a commercial property). Here is a checklist that residential landlords can claim including:

If you seek advice from the correct property tax specialist, you will pay less income, inheritance, and capital gain tax. Property developers can consult an expert to get advice and set a proper structure for their property wealth. If you have a property in the UK, you should hire a specialist property tax accountant.

Yes, HMRC investigates landlords. HMRC has several ways to investigate who undeclared their rental income. The HMRC has the right to go back 20 years if someone has undeclared rental income. Undeclared rental income is a criminal offence and can result in higher tax bills and penalties. So always keep a record of your rent-out properties and declare them to the HMRC.

There are few tax rules for buy-to-let properties which an accountant can easily understand. A buy-to-let accountant works for buy-to-let landlords to ensure whether they are tax compliant or not as a landlord. Nowadays, Landlords and property investors are investing in the buy to let properties in the UK for capital growth and to generate rental income.

Our experts are specialist buy-to-let property accountants and offer comprehensive buy-to-let landlord accounting services and property taxes services for buy-to-let landlords and property investors.

If you are a landlord renting out your property individually or as a limited company, the financial and administrative responsibilities are there to manage. Keeping track of your obligations, submitting accounts and returns, registering for self-assessment, and declaring your earnings in an annual tax return are essential.

The variety of taxes you need to pay. Some of them are irrelevant but essential to be aware of.

dns UK property accountants for landlords help with an efficient service to take care of your tax position and maximum tax relief. Managing the tasks as a landlord can be quite challenging, especially if you have multiple properties to manage and tenants to maintain. Landlords and property investors should hire a specialist property accountant to make it easiers.

Yes, you are subject to income tax for the tax year in the UK on UK rental property. But take care you do not also become liable to foreign tax where you work.

If you are a UK resident, you are subject to income tax on worldwide property income in the UK. But take care you are allowed to buy, and you do not also become liable to foreign tax wherever you are planning to buy

Suppose this is your first purchase or main residence. In that case, First Time Buyer relief may be available to reduce your stamp duty bill for properties which are less than a specific value, according to UK property accountants.

You may be entitled to SDLT relief for multiple dwellings if you purchase more than one property.

If you have a single buy-to-let property or you are a limited company owner who deals with property businesses, hiring property tax specialists can help you effectively. Many landlords and property investors nowadays prefer specialist accountants to save money before investing in marketing. Get free consultations from dns tax specialists and benefit from our best service.

These are the expenses you can claim as a landlord in the UK:

Dns offers property accounting services for BTL (Buy-to-let) landlords, which help UK & Non-UK landlords to manage taxes and accounts of their buy-to-let properties. We can serve better specialist landlord accounting services to landlords operating as a limited company, partnership or limited liability partnership, an individual.

Limited time only!

Say Goodbye to Bookkeeping Hassles: Nomi offers Free Receipt Processing and big savings!

We are using cookies to give you the best experience on our website. By accepting to use our website, you agree to our cookies policy

X