We help with IR35 reviews freelancers

Finding your IR35 status and checking it’s correct can be challenging. An IR35 contract review will give you clarity, could save you money and keep you outside of IR35. Because, if you’re inside IR35, you’ll be liable to additional income tax and National Insurance contributions.

An IR35 review should be something you do before you start a contract or project and you should review this every six months or whenever you sign an extension. Only then will you ensure that you’re compliant with latest IR35 legislation.

BOOK A CALL BACK CALL US

Built by accountants just for you

There are huge benefits to using the dns IR35 review service,

here’s just a few of them…

Free Business Software!

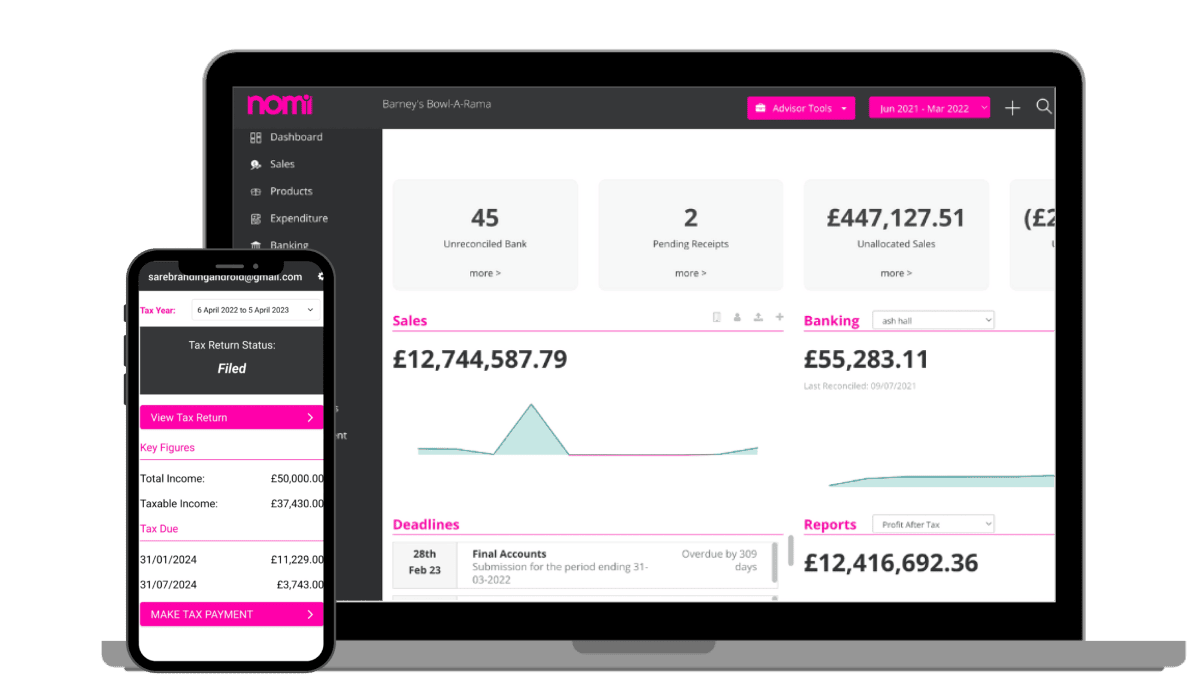

Say Goodbye to Bookkeeping Hassles: Nomi offers

accounting Free Receipt Processing and big savings!

Built in payment

solutions.

Hasslefree Bookkeeping

Snap pictures of

receipts using the

mobile app

Connect your bank

for easy reconciliation

Track your debtors

and creditors

Free Receipt Processing

Accounting anywear

Our leading IR35 review service can help you with all your needs including:

- Status confirmation: Outside/Inside IR35

- Concise report

- Working practices assessment

- Suggestions to strengthen the terms of contract

- Full working practices review

- IR35 pass certificate (if compliant)

See how dns can help you today.

Do you need IR35 contract review help from leading experts who are up to date with

current legislation and case law? Give us a call today on 03300 886 686 to

speak to our advisors, we'll find the right solution to all IR35 needs.

Trusted reviews

Read what our clients think about us

I am writing this email as a token of appreciation for Manish Garg, who is our lead accountant for the past...

Read moreWe work with DNS Associates for 4 years now and we always had a feeling that our problems and questions are top...

Read moreDNS Associates provides cost effective and very professional services. My accountant Sneha Gurudutta has been...

Read moreVery professional and efficient team. I will highly recommended to all small or big business owners...

Read moreI’m a new client and Debangshu Sarkar has been reliable, timely and informative to date. Very impressed...

Read moreExcellent services, my account manager Amit Gupta always there for me, excellent work on time and take...

Read moreI recently starteed my own company and in need of a good accountant. With my friends reference, I started...

Read moreI have been using DNS Services over a year from setting up my company till date. They are extremely professional...

Read moreAmbarish V

I am writing this email as a token of appreciation for Manish Garg, who is our lead accountant for the past couple of years. Manish is a very helpful person who often goes above and beyond to ensure that clients are fully satisfied and happy with the service provided by DNS. He also has a friendly attitude coupled with excellent subject knowledge and attention to detail, and is certainly a great asset for the company. Owing to such a fantastic service provided by Manish, I will always recommend DNS associates to all my contractor friends and colleagues.

Max Floor UK

We work with DNS Associates for 4 years now and we always had a feeling that our problems and questions are top priorities for them, especially Elena Ursuta our account manager who always helped us out. Would recommend DNS.

Jivan Sharma

DNS Associates provides cost effective and very professional services. My accountant Sneha Gurudutta has been always very keen to assist with whatever queries I may have. They are punctual and provide excellent service throughout.

Jhon Gill

Very professional and efficient team. I will highly recommended to all small or big business owners. Amit Gupta is our account manager and he is handling our two companies accounts. he is very helpful and he always notify us time to time . Thank you Amit Gupta and all DNS accountants team.

Freddie Sam Webber

I’m a new client and Debangshu Sarkar has been reliable, timely and informative to date. Very impressed with the service.

Ghofran Abdelrehem

Excellent services, my account manager Amit Gupta always there for me, excellent work on time and take every extra mile for my business, always gives the time to explain. Really can’t complain.

Sateesh B

I recently starteed my own company and in need of a good accountant. With my friends reference, I started DNS accountancy services and I am a quite satisfied with their service. My account manager Sneha Gurudutta was always responsive and guided me a lot especially during my company early days. Keep u the good work.

Satya Suresh

I have been using DNS Services over a year from setting up my company till date. They are extremely professional and flexible.We get support on weekends too which is a handy. Above all Sneha Gurudatta is always helpful and very quick in getting up the things done.Thanks a lot for the good job Sneha. I already recommended few people and will continue the same in future .Thank you.

Got questions?

Intermediaries' legislation or 'IR35' as it's commonly known, is a set of anti-avoidance rules that were introduced in April 2000, to prevent disguised employment. It was designed to stop contractors, who worked through their own limited companies, but would otherwise be classified as employees, from gaining the tax benefits associated with working in this way.

Prior to these rules, a worker would resign from his employment on Friday and return on Monday to the same role in the same company but as a contractor. The only difference being he is now employed by a personal service company of which he is a controlling shareholder and director.

By providing services through their own company, the worker could avoid national insurance contributions and minimise his tax liability by paying himself through a combination of salary and dividends. The original employer on the other hand could avoid paying Employer's NI, thus saving 13.8%. IR35 rules were implemented to deter such activities, by removing the tax benefits.

As a contractor it is imperative that you are aware of IR35 legislation, as it affects everyone in the contracting business. In a nutshell, IR35 legislation tries to tax your company income as employment income meaning that almost all of the tax advantages gained will be lost if you fall foul of IR35.

Many contractors work via their own personal one man service company. This company is known as a personal Service Company – PSC for short.

In the chain between the contractor and the end user there is one organization that contracts with the personal service company, or umbrella company. This last organisation/agency to pay on invoice is termedthe fee payer, or engager. In the absence of the agency, the end client will be the fee-payer.

Under the draft new rules, clients will be required to supply to the individual contractors and all intermediaries, a Status Determination Statement (SDS) advising IR35 status and the reasons for coming to that decision.

Under current rules there is no right of appeal on IR35 status. Thus, speaking with your client is the best way to understand the reason behind the decision of your client regarding your work status.

However, the draft new rules, include a right of appeal that may be applicable from April 2021 but not before.

Under these new rules the individual contractor can appeal and make representation to the client to assist in determining status. These representations must be considered within 45 days and either a new certificate issued or the old one ratified.

HMRC have released a Check Employment Status Tool (CEST) for use in determining IR35 status. Unfortunately, like all its predecessors it is flawed. It has been acknowledged that in 15% of cases it cannot make a decision at all. But assessing IR35 status is an art not a science so it would be impossible to do accurately from a question and answer session alone.

HMRC have advised that if you can get it to give you a decision of not caught, with accurate information inputted, then they will stand by that answer – however in a recent court case they tried to throw out such a result as irrelevant.

In all we would not recommend using this tool alone in making status determinations.

However, this does not stop many clients wanting to use this tool to make their decisions.

If caught by off-payroll working and IR35 then the end client is responsible for calculating your PAYE. The can delegate this down the supply chain to an intermediary, but the PAYE has to be deducted before payment is made to your personal service company.

If not subject to off payroll working but you have your own limited company, then your company is responsible for calculating and paying over any PAYE taxes due.

If working via an Umbrella company then they will calculate and deduct all the PAYE taxes necessary.

If you go on the client or agency payroll then the client/agency will calculate and deduct all the PAYE taxes necessary.

In the first instance, under off payroll working, the client determines your status. You may challenge this determination after 6th April 2021 at any time.

If you are judged caught when not, then only you are likely to complain, and you have to do this within 45 days, so the taxes may be refunded to you.

If you are judged caught by IR35, now or in the future, then the client is responsible for collecting and paying the tax & NIC. HMRC may collect these taxes from the client or any intermediary/agent down to the fee payer of your PSC.

It is for this reason that clients do not want to continue to pay a PSC. Many private clients are therefore now only offering the options of payroll or an Umbrella solution for future contracts, whereas the public sector have mostly chosen to err on the side of deducting the PAYE taxes today, rather than risk a bill in the future.

Under off-payroll, PAYE will be calculated and deducted based on when the services are performed. Hence these new rules affect all services carried on or after 6th April 2021. As per HMRC guidance, any payment made for work carried out prior to 6th April 2021 will not be caught under the off-payroll working rules.

It is therefore recommended that you review all contracts before 5th April 2021.

If you are a contractor working for your own PSC or partnership and the end client is large or medium sized then yes you are effected by the reforms. Your end client will need to assess your IR35 status for all services carried out after 6th April 2021.

Still have questions?

Free Business Software!

Limited time only!

Free Business Software

Say Goodbye to Bookkeeping Hassles: Nomi offers Free Receipt Processing and big savings!

- Built in payment solutions.

- Track profitability, debtors and creditors

- Snap pics of receipts with the mobile app

- Free Receipt Processing

- Hasslefree Bookkeeping

- Cost Reduction

Close

We are using cookies to give you the best experience on our website. By accepting to use our website, you agree to our cookies policy

X