We help with

investigation/Enquiry

In recent years, VAT alone generated over £132 Billion pounds for the British economy. Therefore, it is one of the most favoured areas of HMRC’s enquiry. VAT officers can visit your business to inspect your VAT records and ensure you’re paying or reclaiming the right amount.

dns accountants is an industry leader available to offer expert advice to appeal the findings of a recent HMRC investigation. Our team of investigation specialists comprise Chartered Tax Advisers who have extensive experience in dealing with VAT investigations.

BOOK A CALL BACK REQUEST A FREE CONSULTATION CALL US

Built by accountants

just for you

There are huge benefits to taking out dns tax investigation cover,

here’s just a few of them…

covered

representation

helpline

and simple

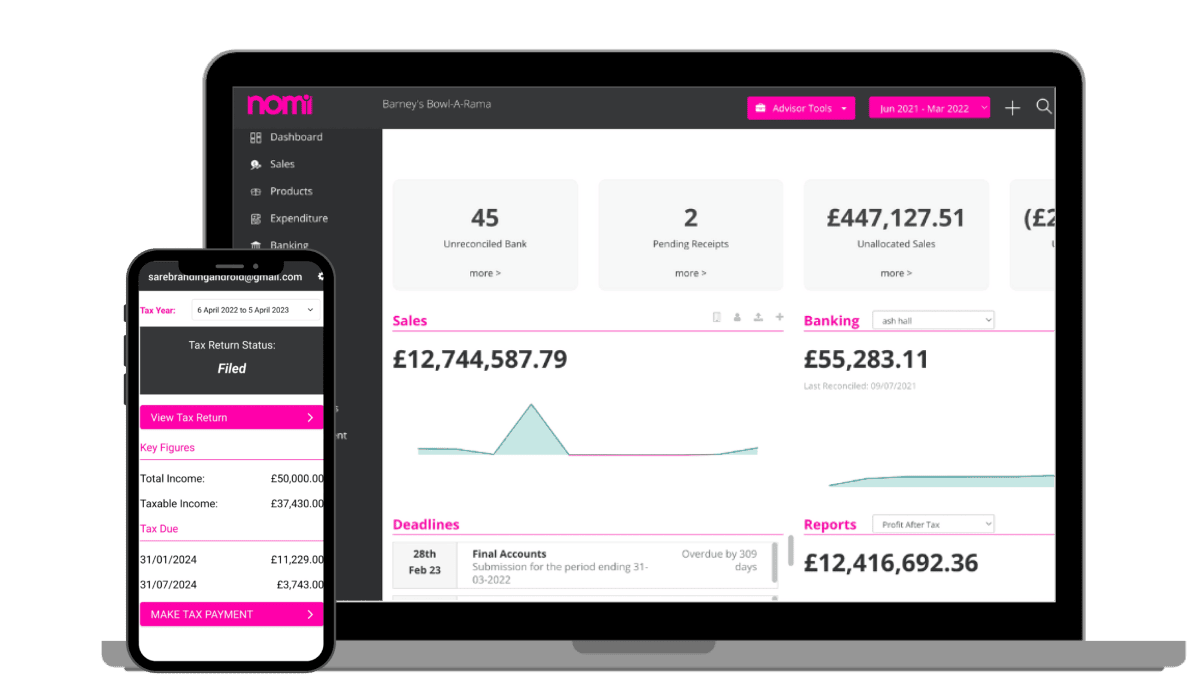

Free Business Software!

Say Goodbye to Bookkeeping Hassles: Nomi offers

accounting Free Receipt Processing and big savings!

Built in payment

solutions.

Hasslefree Bookkeeping

Snap pictures of

receipts using the

mobile app

Connect your bank

for easy reconciliation

Track your debtors

and creditors

Free Receipt Processing

Accounting anywear

Whatever type of investigation is opened against you we can handle it and having tax investigation cover gives you the peace of mind of knowing you’ve got experts on your side, and it won’t cost you a fortune. Our cover includes:

- Income tax self-assessment

- Corporation tax assessment

- Partnership & director enquiries

- PAYE/VAT compliance visit cover

- HMRC IR35 enquiries

- Employer compliance disputes

- HMRC VAT disputes

See how dns can help

you today.

With over 50 years of combined experience in the industry, dns can deal with your VAT investigations to achieve excellent output. Give us a call today on 03300 886 686 to speak to our advisors, we'll help you with all your tax investigation needs.

Trusted reviews

Read what our clients think about us

I am writing this email as a token of appreciation for Manish Garg, who is our lead accountant for the past...

Read moreWe work with DNS Associates for 4 years now and we always had a feeling that our problems and questions are top...

Read moreDNS Associates provides cost effective and very professional services. My accountant Sneha Gurudutta has been...

Read moreVery professional and efficient team. I will highly recommended to all small or big business owners...

Read moreI’m a new client and Debangshu Sarkar has been reliable, timely and informative to date. Very impressed...

Read moreExcellent services, my account manager Amit Gupta always there for me, excellent work on time and take...

Read moreI recently starteed my own company and in need of a good accountant. With my friends reference, I started...

Read moreI have been using DNS Services over a year from setting up my company till date. They are extremely professional...

Read moreAmbarish V

I am writing this email as a token of appreciation for Manish Garg, who is our lead accountant for the past couple of years. Manish is a very helpful person who often goes above and beyond to ensure that clients are fully satisfied and happy with the service provided by DNS. He also has a friendly attitude coupled with excellent subject knowledge and attention to detail, and is certainly a great asset for the company. Owing to such a fantastic service provided by Manish, I will always recommend DNS associates to all my contractor friends and colleagues.

Max Floor UK

We work with DNS Associates for 4 years now and we always had a feeling that our problems and questions are top priorities for them, especially Elena Ursuta our account manager who always helped us out. Would recommend DNS.

Jivan Sharma

DNS Associates provides cost effective and very professional services. My accountant Sneha Gurudutta has been always very keen to assist with whatever queries I may have. They are punctual and provide excellent service throughout.

Jhon Gill

Very professional and efficient team. I will highly recommended to all small or big business owners. Amit Gupta is our account manager and he is handling our two companies accounts. he is very helpful and he always notify us time to time . Thank you Amit Gupta and all DNS accountants team.

Freddie Sam Webber

I’m a new client and Debangshu Sarkar has been reliable, timely and informative to date. Very impressed with the service.

Ghofran Abdelrehem

Excellent services, my account manager Amit Gupta always there for me, excellent work on time and take every extra mile for my business, always gives the time to explain. Really can’t complain.

Sateesh B

I recently starteed my own company and in need of a good accountant. With my friends reference, I started DNS accountancy services and I am a quite satisfied with their service. My account manager Sneha Gurudutta was always responsive and guided me a lot especially during my company early days. Keep u the good work.

Satya Suresh

I have been using DNS Services over a year from setting up my company till date. They are extremely professional and flexible.We get support on weekends too which is a handy. Above all Sneha Gurudatta is always helpful and very quick in getting up the things done.Thanks a lot for the good job Sneha. I already recommended few people and will continue the same in future .Thank you.

Got questions?

Most tax investigations happen because HMRC has reason to believe that some aspect of your tax return or business accounts is wrong. They may have received a tip off, some figures in the tax return may not tally with other information they have, or the return may have been sent in late.

One important way to minimise the risk of becoming a target for investigation is to make sure your personal tax return and company accounts are always delivered to the appropriate agency (Companies House/HMRC) on time. Another way to avoid suspicion is to use the dns online accounting portal, employ a good accountant, keep hold of receipts and be scrupulous about correct reporting. Another thing, never ignore any correspondence from HMRC.

No. HMRC randomly selects a proportion of tax returns every year. In the first two years of self-assessment, some 15,000 returns were investigated. HMRC will write to you to let you know that your affairs are being investigated although it will not normally give the reason behind its decision to launch an enquiry. Under the self-assessment regime, the Revenue must start any enquiry within 12 months of the last filing date of 31 January but there is no requirement for an investigation to conclude within a fixed period of time.

HMRC ensures whether you're paying the right amount of tax or not, so don’t be surprised if you are being investigated.

Most small to medium sized businesses only get a visit once every 3-4 years. If you have received a VAT inspection notice, it could be due to several reasons;

- A routine inspection.

- Trade class.

- Inaccurate submissions.

- Regular repayment claims.

- Past compliance history.

- Discrepancies in submitted VAT figures against industry benchmarks.

- Tip-offs.

dns accountants understand how to handle your VAT investigation procedure and deliver the best outcome.

If it is found that a tax payer has intentionally misled the tax authorities, punishment can be severe: prosecutions, jail sentences and stiff fines designed to recoup the unpaid tax and penalties.

HMRC usually contacts you to arrange a visit. They normally give you seven days’ notice. They’ll confirm what information they want to see, how long it’s likely to take and if they want to inspect your premises. You can also ask them to delay the visit.

HMRC can look back up to 20 years to recover VAT lost due to criminal or civil VAT fraud. HMRC has the power to arrest, without a warrant, anyone suspected of criminal VAT fraud or using false documents (Value Added Tax Act 1994 S.72 (9)).

Part of HMRC’s review of powers has sought views on applying the relevant provision in the Police and Criminal Evidence Act 1984 (PACE) across all of its activities.

Changes introduced in the Finance Act 2007 gave trained officers harmonised powers to apply for search warrants, production orders and powers of arrest across all areas of taxes. These are subject to important safeguards generally attached to criminal investigations.

In serious cases of fraud, HMRC can bring in the Special Compliance Office, an elite unit responsible for the most high-profile investigations. The SCO has the power to negotiate settlements and can also agree not to prosecute a taxpayer as long as full disclosure is made.

Yes, but taxpayers’ affairs are confidential and information will only be disclosed to people that the individual agrees it may be given to, such as dns or another adviser. But, HMRC can ask former employers, customers, suppliers or colleagues for information relating to its investigation

Yes, of course, but you may have to go back through the whole accounts’ years (legally you must keep six years), and to collate this and submit it all is quite a job if you are still trying to run a company.

Yes, if you have subscribed to our Tax Investigation Service we will look after searching, collating, submitting all the documents requested and required. We will liaise with the tax authorities on your behalf and help you every step of the way. You will also have access to a legal helpline to make your tax investigation work easy.

There is an article on our blog. Or you can visit the HMRC website for more detailed information.

Still have questions?

Free Business Software!

Limited time only!

Free Business Software

Say Goodbye to Bookkeeping Hassles: Nomi offers Free Receipt Processing and big savings!

- Built in payment solutions.

- Track profitability, debtors and creditors

- Snap pics of receipts with the mobile app

- Free Receipt Processing

- Hasslefree Bookkeeping

- Cost Reduction

Close

We are using cookies to give you the best experience on our website. By accepting to use our website, you agree to our cookies policy

X