Hassle free accounting

All your accounting needs in one place. Online leading software and in person with our friendly team.

- No penalty guarantee

- 4 hour response

- Dedicated account manager

- Free cloud software

We work with thousands of freelancers across the UK to help them with all their tax and accountancy needs including setting up a company, bookkeeping, incorporation, expense management, tax planning and so much more.

Our freelancers accountants packages give you a range of services to suit your needs and budget. If you're juggling your clients or customers and need more time to work on your business, why not outsource all your accountancy, tax and bookkeeping to dns?

BOOK A CALL BACK REQUEST A FREE CONSULTATIONIf you're a self-employed freelancer and need more time to work on your business then dns can help to free your time and take care of all your accountancy and tax needs. Our specialist freelance experts offer a full range of services for all your freelancer needs.

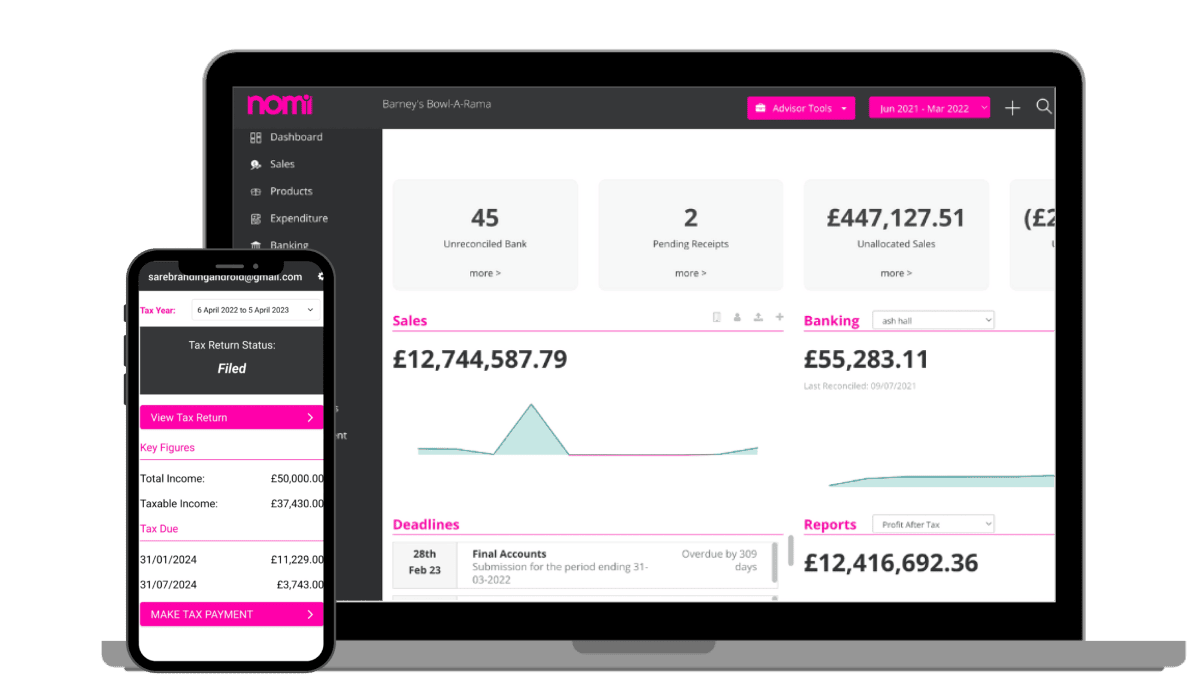

Say Goodbye to Bookkeeping Hassles: Nomi offers

accounting Free Receipt Processing and big savings!

Built in payment

solutions.

Hasslefree Bookkeeping

Snap pictures of

receipts using the

mobile app

Connect your bank

for easy reconciliation

Track your debtors

and creditors

Free Receipt Processing

We support and advise thousands of people just like you across the UK and abroad

with our amazing team of experts.

All your accounting needs in one place. Online leading software and in person with our friendly team.

Tax experts to help you minimise your tax bill and save you money.

Our services give you complete control and support for all your freelancer needs.

We've got a range of packages to suit all types

of people

Signing up or making the switch to dns accountants is simple. We make it

as quick and easy as possible.

Call us to chat through your requirements.

Schedule a meeting

online

Sign up and we’ll

do the rest

Got questions?

Any person or individual who decides to start his own practice or business is referred to as a Sole Trader or Self-employed individual. The first of these is Register as self employed with HMRC and, most likely, Set up as a sole trader or freelancer. The business can enroll with HM Revenue and Customs (HMRC) anytime up to October 5, starting from the business’ second tax year. If the business is already registered, a sole trader can use the online service to:

According to the UK Government, starting business as a sole trader is the easiest way to start a business in the United Kingdom. For a freelancer, to start working as a sole trader, the requirements are:

Unless there is any industry-specific license needed, a freelancer is free to start working. There is no need to register with Companies House because although it is a legitimate business, it isn’t a company.

It is very simple and straightforward to run a Limited Company.

There is more opportunity for tax planning through a Limited Company but only experienced specialist freelancer accountants can guide the business about this. The most important savings working through a Limited Company over an umbrella are National Insurance and the Flat Rate Value Added Tax (VAT) Scheme. All Umbrella Companies in the United Kingdom operate as PAYE. This means that tax is paid in the same way as a permanent employee

The flat rate scheme is an incentive provided by the government to help simplify taxes. The amount of Value Added Tax (VAT) a business pays or claims back from HM Revenue and Customs (HMRC) is usually the difference between the VAT charged by the business to the clients and the VAT the business pays.

Example:

A freelancer bills a client for £1,000, adding 20% VAT to make the total bill amount: £1,200. As an IT consultant, the VAT flat rate charged for the business is 14.5%. Hence, the flat rate payment will be 14.5% of £1,200, or £174.

Limited time only!

Say Goodbye to Bookkeeping Hassles: Nomi offers Free Receipt Processing and big savings!

We are using cookies to give you the best experience on our website. By accepting to use our website, you agree to our cookies policy

X