All your accounting needs in one place. Online leading software and in person with our friendly team.

- No penalty guarantee

- 4 hour response

- Dedicated account manager

- Free cloud software

Getting a good accountant for your new business should be an early decision you make. Why? Having a startup accountant London from day 1 or even when you’re still planning your new business venture will give you the support and advice you need.

Whether it’s advice on your business structure, registering with HMRC, forming a limited company, or getting a business bank account, dns can help with all that and more. We’ve got packages to suit your needs and budget. We’re award winning accountants that offer services online and in person.

BOOK A CALL BACK REQUEST A FREE CONSULTATION

Startup businesses are one of specialisms here at dns and we support thousands of startups every year. Our specialist team of accountants for startups businesses experts offer a full range of services for all your accountancy, tax and startup needs.

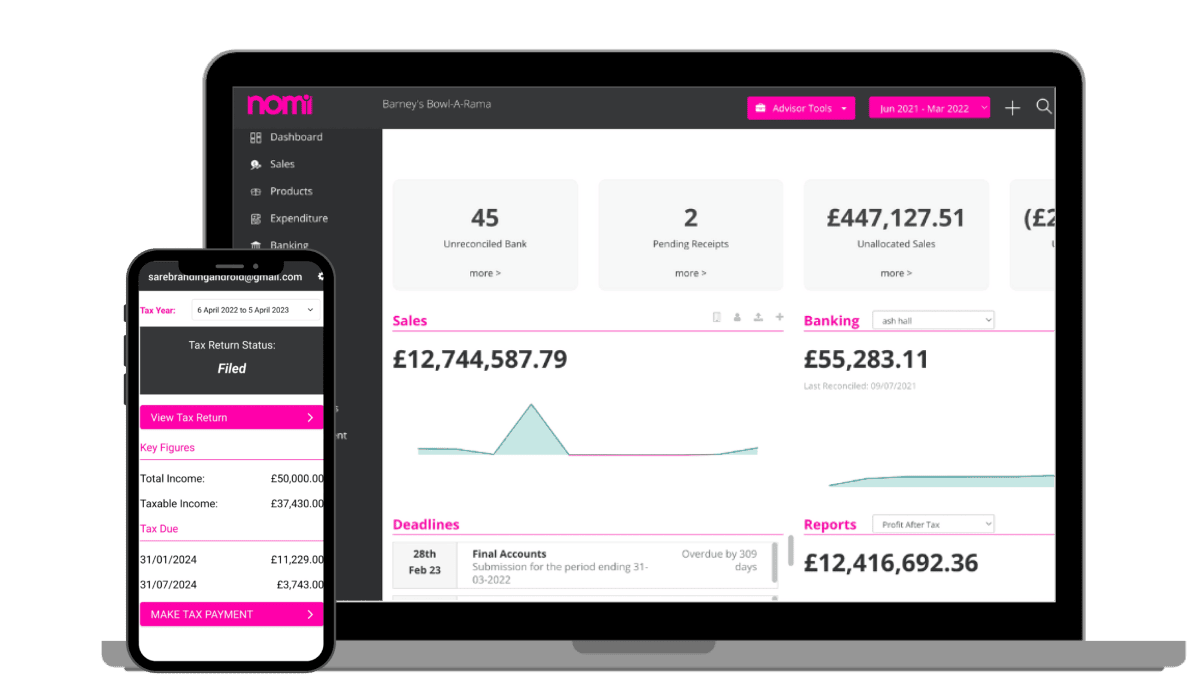

Say Goodbye to Bookkeeping Hassles: Nomi offers

accounting Free Receipt Processing and big savings!

Built in payment

solutions.

Hasslefree Bookkeeping

Snap pictures of

receipts using the

mobile app

Connect your bank

for easy reconciliation

Track your debtors

and creditors

Free Receipt Processing

We support and advise thousands of people just like you across the UK and abroad

with our amazing team of experts.

All your accounting needs in one place. Online leading software and in person with our friendly team.

Tax experts to help you minimise your tax bill and save you money.

Our services give you complete control and support for all your startup needs.

We've got a range of packages to suit all types

of people

Signing up or making the switch to dns accountants is simple. We make it

as quick and easy as possible.

Call us to chat through your requirements.

Schedule a meeting

online

Sign up and we’ll

do the rest

Got questions?

By choosing a low-cost business model, it’s absolutely possible to start a business with no money. Here’s just some ideas opportunities for all you budding business owners out there.

A sole trader is a self-employed person who runs and owns their own business by themselves. If you're a sole trader, you have no legal identity separated from your business. Due to this, many people describe sole traders as a business themselves.

Overall, the main difference between a sole trader and a limited company is that a sole trader is owned and controller by one individual. This means the person has unlimited liability for the business no matter the circumstance. On the other hand, a limited company has split ownership into equal shares between how many people are involved. This can help alleviate some strain and financial stress and leave you with less of a personal return at the end of each year.

If you are a new business, we hope you will have read the dns small business start up kit. If you are an existing business operating as a sole trader, we hope this table will help you see the benefits of working through a limited company.

Below are the average returns you can expect to see working as a sole trader or through a limited company.

| Profit £ | Ltd company tax £ | Sole trader tax £ |

|---|---|---|

| 20,000 | 4,200 | 5,600 |

| 30,000 | 6,300 | 8,400 |

| 40,000 | 8,400 | 11,200 |

| 50,000 | 10,500 | 14,928 |

| 60,000 | 12,600 | 19,029 |

| 70,000 | 14,700 | 23,129 |

The benefits of working through a limited company are obvious.

Starting a new business might be complicated at first, and the majority of people run across similar difficulties. Many people consider establishing a business, but only a small percentage emerges as successful entrepreneurs and business owners. You must possess certain essential qualities to convert yourself into a successful business owner-

While being kind to others may seem self-evident, but developing relationships with your employees, customers, vendors, and even competitors can result in increased business. It is a well-established fact that the more employees admire and respect their employers, the higher their sense of team motivation will be. Additionally, customers are persuaded by more than just the product; they are also influenced by what a brand signifies. If you are kind to others, your customers will associate your pleasant demeanour with your product.

Small business owners must be flexible and willing to roll with the punches. Markets inherently shift over time, and business owners must adapt in order to maintain their products relevance. Refusing to adapt your strategy to consumer wants and needs can ultimately cost you in the long run.

Create a detailed plan for your businesss first five years, including your strategy and marketing approach. Planning your business enables you to comprehend business assumptions – the number of consumers you'll require, the price you'll charge, and the rate at which the business will grow. Describe the market and your target audience, as well as your competitors, in your business strategy. Pricing, production costs, marketing, and advertising expenses should all be planned ahead of time so you can estimate your revenues.

According to Mark Zuckerberg, Facebooks CEO, "the greatest danger is not taking any risk." Creating a business is always a gamble; there is no way to know if it will succeed. While successful small business owners make informed decisions and conduct market research to enhance their ideas, there is no way to predict the future. Investing your own time and money in a business is always risky, but it goes side by side being a business owner.

Entrepreneurship requires both the ability to think for oneself and the capability to make key decisions. Independence provides the motivation to accomplish goals without concern for the views of others or external noise. Perhaps you have an original concept for a product or service that has not been developed earlier. Independence enables you to put yourself forward and take the initiative to make things happen.

Confidence and independence often coexist. It is essential to have confidence in your company and financial decisions. Because your business exists or dies with you, you must believe in yourself in order to continue forward, even if you are going through challenging times. This has a substantial effect on team management. Strong leaders are rewarded with greater staff productivity and creativity, which helps the business run more efficiently.

While it is true that small business entrepreneurs work long hours, they also know when to relax. Burnout is a state of tiredness, cynicism, and inefficacy that can appear as feelings of overload and decreased motivation. The easiest approach to avoid it is to ensure that certain successful habits, such as scheduling time away from your business, are included in your everyday life.

Even if you only have thirty uninterrupted minutes to devote to yourself or spend with loved ones, make the most of it. Additionally, refrain from looking at financial reports or emails during this period. Successful business owners recognize the importance of detaching from their work, even if it is only for a few minutes each day.

Have you ever heard the saying that success is not linear? This is especially true for entrepreneurs. It typically takes time for any business to become profitable and work out any kinks so that operations function smoothly. You may not get it right from the start. You'll almost certainly need to adjust your pricing, business model, or even your product along the way. However, determination and refusal to give up are what will bring you through.

Overspending could be harmful to your organisation. When developing a budget and company plan, a good rule of thumb is to overestimate expenses and underestimate income. This way, you'll never be stretched too thin and can always anticipate unforeseen costs.

As a business owner, you'll need to polish your project management skills in order to evaluate which jobs are most critical to the firm and which may be delegated. A decent way to start is by categorising your list of tasks as either important or urgent.As a rule of thumb :

Its easy to get caught up in the stresses of life. Any issues you encounter may drive you to reconsider why you started your business in the first place. However, keep those reasons in mind and focus on your overall success rather than minor setbacks - this is what will keep you moving forward in the long run.

These ideas are easy to implement, don’t take much time or knowledge and are free or low cost to implement.

Google My Business is a free tool that allows you to promote your business on Google Search and Google Maps. With your Google My Business account, you can see and connect with your customers, post updates to your Business Profile, and see how customers are interacting with your business on Google. You’ll need to verify your business address (normally via a postcard that Google send to the address)

You don’t need a website for the listing as Google will automatically use the information and photos from your Business Profile on Google to create a site that you can customise with themes, photos, and text. Your free site will automatically update whenever you change your business information or post new photos.

All social media platforms offer free accounts to individuals and businesses. They are a great way to reach large, widespread audiences, build communities and promote your business. Create business or personal accounts on the most relevant social media sites for your audience (for example LinkedIn for Business to Business (B2B) marketing, Instagram is good for product marketing etc.)

Check out the sites best suited to your business – learn how to use them, set up your profile and post content onto the accounts regularly. A static site that isn’t fed with regular updates could harm your brand and business. To use social media for generating new leads / new business, you’ll need to build online relationships and engage with people regularly.

However, beware not to spread yourself too thinly over too many sites. Start small with maybe one social media sites and then build from there.

Creating a simple website nolonger has to break the bank, require years of studying code or be an expert designer. With great sites like Wordpress, Wix, GoDaddy and web.com having amazing ready designed templates and great online training, creating your first website can be quick, simple and cheap to do. With prices starting at less than £10 a month, building a website doesn’t need a big budget.

Having a website will add credibility to your company and your brand and make you visible to a much wider audience. A website should form the hub of all your digital or online marketing.

If you have a website, the best part about Google is that its algorithm is designed to serve up local, accurate, high quality and relevant content for any search that someone does. In many instances, this makes it a much more level playing field between small and bigger businesses.

Yes, large companies employ SEO experts, but there are loads of online training, help and tools to be able to learn the basics yourself. Things like adding in location references in your website content, using key words in headings and sub-headings, adding in links to other websites, other pages on your site and getting listed on free online directories can all help.

Email marketing doesn’t have to cost a fortune. Collect email addresses from your customers and prospective customers. Put them in a spreadsheet or into a free CRM system (such as HubSpot). It’s possible to also buy email data (beware of GDPR rules when buying data). Then use free email marketing systems (such as Mailchimp, Sender or HubSpot).

Email marketing isn’t a new marketing technique, but it remains a quick, easy, and cheap way to reach out and promote your business to your customers and prospective customers. If you use paid for email marketing software, it can contain loads of ready designed templates that you can put your brand onto to send out great looking email campaigns.

One great way to get noticed and engage people online is to write content or start a blog as part of your marketing efforts. Blogs can help drive traffic to your website, increase engagement, add to your credibility, and improve your online visibility. It’s completely free, but just takes time.

If you’re not sure where to start with writing, then read other peoples blogs on similar topics and take ideas and inspiration from them. Blogs don’t have to be long or complex. Remember, your audience isn’t an expert in your subject matter. Talk about your business, your journey, tell a story, educate your audience by sharing your knowledge, write articles giving people tips and tricks to engage them. Share these blogs via social platforms, your website and online blogging platforms.

Our main aim at dns Associates is to provide a proactive service to our clients, whilst ensuring that they are making the most of any potential accountancy savings and tax relief. We also work closely with our clients to help them maximise their profits and business growth, by offering the following benefits:

We take great pride in the work we carry out for our clients, as we always strive to build a strong relationship and provide the most pro-active service. Find out what our clients are saying about us here.

We offer a free consultation to any business or individual who feels that they may be missing out on potential savings, or paying too much for their accountancy, outsourcing or tax advisory services.

VAT Registration is optional if your turnover is less than £85,000. If your Turnover exceeds £85,000 then VAT registration is mandatory. The key to whether you should register or not lies in your customer base: if your customers are mainly businesses and VAT registered you should go for VAT registration, but if your customers are mainly VAT registered customers, you may lose clients to competition.

Example 1 – Registering for VAT can be advantageous

John started his plumbing business and supplies services mainly to industrial customers that are all VAT registered. John should register for VAT and recover his Input VAT (VAT on supplies). Even better, John has the option to register for the VAT Flat Rate scheme.

Small businesses with a turnover of less than £150,000 can join the VAT Flat Rate scheme. This means that you can collect VAT at the full standard rate, while paying at a lesser rate.

For Example if you make sales of £10,000 and collect VAT of £2,000, you could save around £300 to £400 depending on your trade classification. Go to the HMRC Ready Reckoner to check what rate you would pay.

Example 2 – Registering for VAT can be disadvantageous

John decides to expand his business to include household customers. He goes to Mrs Jones’ house to quote for a job and submits a quote to her for £100 plus 20% VAT. Mrs Jones had requested quotes from two of John’s competitors, one of whom does not charge VAT and, therefore, quoted £100. Mrs Jones went for the quote for £100 as, because she’s not VAT registered she can’t recover the VAT. For household customers, Input VAT is an irrecoverable cost.

So John lost out on the job because he was VAT registered, and if you’re VAT registered, you MUST charge VAT.

Registering for VAT is compulsory if your turnover exceeds £85K. However, if your business is turning over £85K it will have a sufficient customer base, financial rigour and inbuilt efficiency to compete with non-VAT registered businesses. So VAT registration can be advantageous and save you some money. BUT be warned if you register too early and you’re client base is mainly domestic, it may work against you, so make sure you get it right.

Registering a company can be a big task if your not sure of where to go and what to do. Apart from getting your company registered with dns's free company formation you also get free business banking from all our business bank accounts. We can also help you get your dormant company active.

Limited time only!

Say Goodbye to Bookkeeping Hassles: Nomi offers Free Receipt Processing and big savings!

We are using cookies to give you the best experience on our website. By accepting to use our website, you agree to our cookies policy

X