We help with

business insurance

Having the right business insurance gives you complete peace of mind and protects you against the worst-case scenarios. But finding a tailored insurance product based on your business activity with the right cover can be a minefield.

At dns we work with top quality business insurance providers and specialists to provide insurance for businesses, contractors, freelancers & self-employed. They’ve got a wide range of insurance products for you and your business helping you plan for the unexpected and be adequately protected.

BOOK A CALL BACK REQUEST A FREE CONSULTATION CALL USBuilt by accountants

just for you

There are huge benefits to getting insured with our insurance partners,

here’s just a few of them…

Free Business Software!

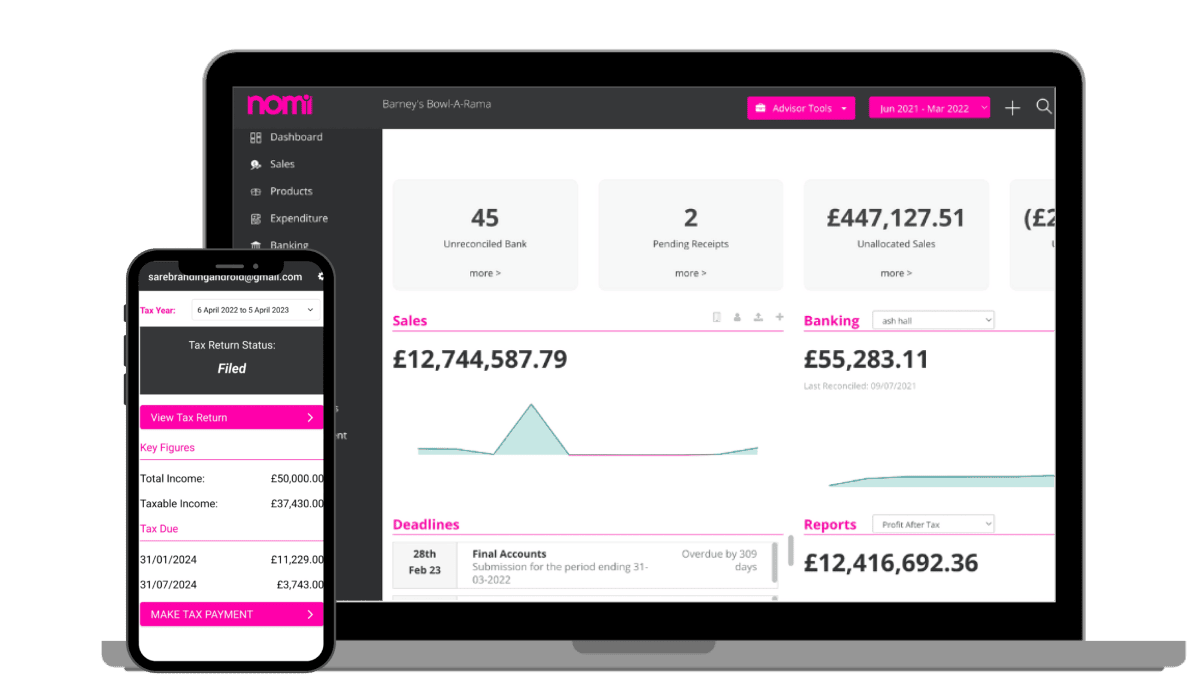

Say Goodbye to Bookkeeping Hassles: Nomi offers

accounting Free Receipt Processing and big savings!

Built in payment

solutions.

Hasslefree Bookkeeping

Snap pictures of

receipts using the

mobile app

Connect your bank

for easy reconciliation

Track your debtors

and creditors

Free Receipt Processing

Accounting anywear

Our insurance providers offer a huge range of specialist insurance for specialist industry sectors. Contact us to find out more, here’s just a small sample of what they offer.

- Professional indemnity insurance

- Employer’s liability insurance

- Public liability insurance

- Contractors combined insurance

- Personal accident insurance

- Property insurance

Accounting anywear

Caunce O’Hara insurance offer a huge range of specialist insurance for specialist industry sectors. Check out their website to find out more, or here’s just a small sample of what they offer.

- Professional indemnity insurance

- Employer’s liability insurance

- Public liability insurance

- Contractors combined insurance

- Personal accident insurance

- Property insurance

Accounting anywear

Caunce O’Hara insurance offer a huge range of specialist insurance for specialist industry sectors. Check out their website to find out more, or here’s just a small sample of what they offer.

- Professional indemnity insurance

- Employer’s liability insurance

- Public liability insurance

- Contractors combined insurance

- Personal accident insurance

- Property insurance

Accounting anywear

Caunce O’Hara insurance offer a huge range of specialist insurance for specialist industry sectors. Check out their website to find out more, or here’s just a small sample of what they offer.

- Professional indemnity insurance

- Employer’s liability insurance

- Public liability insurance

- Contractors combined insurance

- Personal accident insurance

- Property insurance

See how dns can help

you today.

Still not sure about what insurance you require? Give us a call today

on 03300 886 686 to speak to our advisors, we'll find the right solution to all insurance needs.

Trusted reviews

Read what our clients think about us

I am writing this email as a token of appreciation for Manish Garg, who is our lead accountant for the past...

Read moreWe work with DNS Associates for 4 years now and we always had a feeling that our problems and questions are top...

Read moreDNS Associates provides cost effective and very professional services. My accountant Sneha Gurudutta has been...

Read moreVery professional and efficient team. I will highly recommended to all small or big business owners...

Read moreI’m a new client and Debangshu Sarkar has been reliable, timely and informative to date. Very impressed...

Read moreExcellent services, my account manager Amit Gupta always there for me, excellent work on time and take...

Read moreI recently starteed my own company and in need of a good accountant. With my friends reference, I started...

Read moreI have been using DNS Services over a year from setting up my company till date. They are extremely professional...

Read moreAmbarish V

I am writing this email as a token of appreciation for Manish Garg, who is our lead accountant for the past couple of years. Manish is a very helpful person who often goes above and beyond to ensure that clients are fully satisfied and happy with the service provided by DNS. He also has a friendly attitude coupled with excellent subject knowledge and attention to detail, and is certainly a great asset for the company. Owing to such a fantastic service provided by Manish, I will always recommend DNS associates to all my contractor friends and colleagues.

Max Floor UK

We work with DNS Associates for 4 years now and we always had a feeling that our problems and questions are top priorities for them, especially Elena Ursuta our account manager who always helped us out. Would recommend DNS.

Jivan Sharma

DNS Associates provides cost effective and very professional services. My accountant Sneha Gurudutta has been always very keen to assist with whatever queries I may have. They are punctual and provide excellent service throughout.

Jhon Gill

Very professional and efficient team. I will highly recommended to all small or big business owners. Amit Gupta is our account manager and he is handling our two companies accounts. he is very helpful and he always notify us time to time . Thank you Amit Gupta and all DNS accountants team.

Freddie Sam Webber

I’m a new client and Debangshu Sarkar has been reliable, timely and informative to date. Very impressed with the service.

Ghofran Abdelrehem

Excellent services, my account manager Amit Gupta always there for me, excellent work on time and take every extra mile for my business, always gives the time to explain. Really can’t complain.

Sateesh B

I recently starteed my own company and in need of a good accountant. With my friends reference, I started DNS accountancy services and I am a quite satisfied with their service. My account manager Sneha Gurudutta was always responsive and guided me a lot especially during my company early days. Keep u the good work.

Satya Suresh

I have been using DNS Services over a year from setting up my company till date. They are extremely professional and flexible.We get support on weekends too which is a handy. Above all Sneha Gurudatta is always helpful and very quick in getting up the things done.Thanks a lot for the good job Sneha. I already recommended few people and will continue the same in future .Thank you.

Got questions?

There are risks in all types of business and work, so having a comprehensive package of cover that meets your business’ legal liabilities could be useful. Choosing to insure against the risks your business may face could help to safeguard against the cost of unexpected events and potential claims.

There are many factors to consider when deciding what business insurance you need and how much cover you require. For example you need to consider the level of risk you or your company faces and consider things like if you visit customer premises or customers visit your premises, or if you business could impact the public if something went wrong.

You need to think about potential for accidents or damage and theft that might occur. All these factors and more will determine the insurance products you may need. So seeking help from a professional advisor and not just taking out the cover you think you need is advisable.

Liability insurance protects the insurer from any kind of risks of liabilities imposed by lawsuits and damages caused by it. To find out more about liability insurance, click here.

Professional Indemnity Insurance (PII) is important for contractor/individuals who are engaged in some form of professional service or provide professional advice to their clients. Professional Indemnity Insurance (PII) is necessary as it protects a contractor/ individuals from the risk of getting into a dispute or being challenged by an unsatisfied client. Professional Indemnity Insurance (PII) will provide a contractor/individual with professional representation, and pay for indemnity in case a client effectively sues for mistakes made as a contractor. These mistakes could be in the form of:

- Negligence in the form of incorrect advice, or misrepresented data

- Unpremeditated violation of copyright or privacy

- Loss of data and documents

- Contract breach, such as in the supply of software and hardware to a client

- Offense or defamation

To find out more about professional indemnity insurance click here.

Still have questions?

Free Business Software!

Limited time only!

Free Business Software

Say Goodbye to Bookkeeping Hassles: Nomi offers Free Receipt Processing and big savings!

- Built in payment solutions.

- Track profitability, debtors and creditors

- Snap pics of receipts with the mobile app

- Free Receipt Processing

- Hasslefree Bookkeeping

- Cost Reduction

Close

We are using cookies to give you the best experience on our website. By accepting to use our website, you agree to our cookies policy

X